Banks today face mounting pressure from digital-first competitors, shifting customer expectations, and rising compliance demands. Legacy systems, built on fixed rules, can no longer keep up with the speed or scale of modern financial operations. These constraints limit growth, reduce efficiency, and expose institutions to avoidable risks.

Machine learning in banking offers a practical path forward. By analyzing vast volumes of data and learning from patterns, financial institutions can enhance their decision-making processes and deliver more personalized services. The result is faster operations, stronger risk management, and better customer engagement.

In this blog, we examine the most impactful machine learning use cases in banking, break down how organizations can implement them effectively, and outline how to build long-term capability for AI-driven transformation.

Key Takeaways

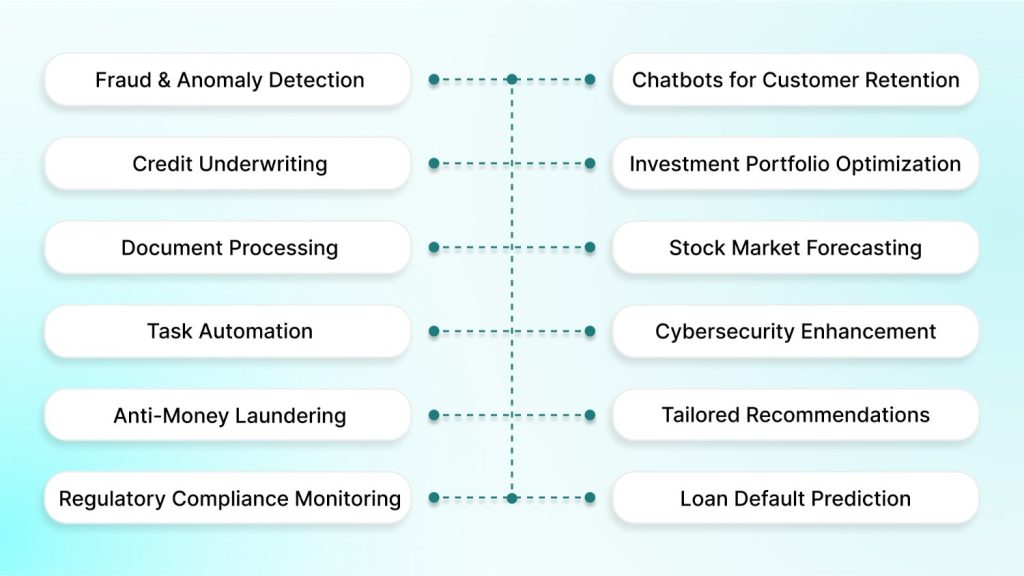

- Machine learning enables banks to enhance fraud detection, credit scoring, customer service, and compliance.

- Common use cases include document processing, chatbots, loan risk prediction, and investment planning.

- To adopt ML successfully, banks need clean data, clear goals, and collaboration between technical and business teams.

- Start with small pilots to test results before expanding across departments.

What is Machine Learning in Banking?

Machine learning in banking utilizes data-driven algorithms to enhance decision-making. It removes the need for manual programming. These models analyze financial data to identify patterns, predict outcomes, and automate tasks that people previously performed.

Banks generate vast volumes of data every second. This includes transactions, customer activity, market changes, and regulatory reports. Machine learning tools scan that data to detect fraud, assess risk, personalize services, and enhance operational efficiency.

As models learn from past data, their predictions become more accurate. This shift enables banks to act proactively before problems arise. They can stop fraud in real time, offer tailored products, and improve efficiency.

12 Practical Use Cases of Machine Learning in Banking

Financial institutions are discovering that machine learning accomplishes much more than just automating tasks. It opens up new ways to manage risk, improve customer service, and increase efficiency, things that older banking systems could not handle.

The examples below illustrate how machine learning addresses real-world problems in banking, driving business outcomes. Each use case adds to a larger system of innovative banking tools that work together to improve service and streamline operations.

Fraud Prevention and Anomaly Detection

Machine learning helps banks detect fraud by spotting patterns that rule-based systems often miss. Instead of flagging every high-value transaction, the models review behavior in real time. They check details such as location, device, merchant, and timing to identify unusual activity.

For example, a customer making a large purchase in their home city might go unnoticed. However, if the same card is used 10 minutes later in another country, the model flags it immediately. These systems utilize supervised learning techniques, such as random forests and gradient boosting, which are trained on years of transaction data.

Banks such as JPMorgan Chase and Capital One now operate fraud detection models that continually learn and adapt. It helped reduce false positives, provide quicker fraud alerts, and minimize disruptions for customers. These models run behind the scenes, scoring each transaction in milliseconds before it’s approved or blocked. Over time, they get better at spotting subtle fraud patterns, especially new or rare ones that rules-based systems would miss.

Credit Underwriting

Previous scoring systems used a fixed formula based on repayment history, credit limits, and age of accounts. They miss context, like income volatility or payment consistency outside formal credit.

Machine learning fills that gap. It ingests dozens of variables: income deposits, job changes, spending habits, rent payments, and even bank statement patterns. Models like gradient boosting trees, such as XGBoost and LightGBM, assign risk scores based on how similar borrowers have performed in the past.

Over time, these models adapt. They learn from actual loan outcomes, flag weak signals earlier, and support fairer lending decisions.

One example is Upstart, a lending platform using ML to approve more applicants with less risk. A CFPB study found it increased loan approvals by 27% and lowered defaults by 16%.

Banks also conduct regular validation tests and bias audits to ensure compliance with regulatory standards. This ensures decisions stay accurate, explainable, and aligned with lending policy.

Document Processing

Manual document handling slows down banking operations and introduces costly errors. A single mortgage file can exceed 200 pages, with manual reviews taking days or even weeks to complete. Staff must classify, extract, and enter data across multiple systems, which drives up labor costs and delays approvals.

Machine learning improves document processing through automation. It uses OCR, natural language processing, and computer vision to classify documents, extract key data, and check it against internal systems or regulatory rules.

Datamatics developed a system for a US bank following a six-way merger. It processed over 35 million mortgage pages. These were sorted into 275 categories with 87% accuracy. The system cut costs by 50% and saved more than 150 staff hours per month.

These tools also handle poor scans, handwritten text, and documents in multiple languages. When the system is unsure, it flags only the relevant sections for human review. This speeds up clear-case processing.

Faster and more accurate handling improves customer service. It reduces delays and avoids repeat paperwork. It also strengthens compliance by capturing data consistently and keeping complete audit trails.

Task Automation

Banking operations involve thousands of small decisions. These include resolving mismatched transactions, verifying documents, and routing internal requests. Many of these tasks follow patterns, but not all can be defined by strict rules. This is where rule-based automation falls short.

Machine learning is beneficial in cases where logic alone is insufficient. It analyzes past outcomes to identify which mismatches are safe, which require manual review, and how to route cases based on context. In reconciliation tasks, it can find likely matches even when the data is incomplete or poorly formatted.

Banks also use machine learning in internal service queues. The models sort requests by urgency, assign them to the right teams, and estimate resolution time based on past trends. This reduces the manual work of triaging and delegating tasks.

By training on operational data, banks can handle exceptions more efficiently and reduce delays.

Anti-Money Laundering

Machine learning strengthens AML systems by spotting suspicious behavior across accounts and transactions. It learns standard patterns and flags unusual activity, such as rapid transfers, unusual routes, or payments associated with high-risk regions.

These models detect tactics such as layering and structuring, which are used to conceal the source of funds. By analyzing timing, counterparties, and transaction flow, they identify links that manual reviews often overlook.

Banks use this approach to create dynamic risk scores. These scores combine transaction history, KYC data, and known risk factors to help teams focus on the most urgent cases.

Some systems also use graph analysis to uncover hidden relationships between accounts. This enhances the detection of complex laundering schemes and accelerates investigations.

Regulatory Compliance Monitoring

Regulatory compliance poses a significant operational challenge for financial institutions. Banks spend billions of dollars annually on compliance activities worldwide. Frequent regulatory changes across jurisdictions increase risk for institutions that cannot respond quickly.

Machine learning helps manage this complexity with automated regulatory monitoring. These systems utilize natural language processing (NLP) to scan regulatory documents. They identify relevant changes and map them directly to internal processes. Thousands of updates are processed simultaneously, with the system distinguishing between minor clarifications and major policy shifts that require urgent attention.

For example, Standard Chartered employs this approach to monitor over 200 regulatory frameworks across its global operations. The platform generates compliance reports automatically, flags potential violations before they occur, and keeps a complete audit trail. As a result, the bank reduced a substantial amount of compliance-related penalties. It also allowed compliance teams to shift from manual review to strategic risk assessment.

Predictive features add even more value. Machine learning models analyze past enforcement patterns to identify activities that are typically subject to scrutiny. When a transaction or process matches those patterns, the system activates preventive measures. This helps institutions avoid violations instead of reacting after the fact.

Chatbots for Customer Retention

Customers expect instant, round-the-clock support, especially for routine banking questions. Machine learning enables chatbots to deliver accurate answers, resolve issues quickly, and reduce wait times without human intervention.

These systems continually improve with every interaction, providing more relevant responses and adapting to customer behavior. Advanced models can sense frustration and pass complex cases to live agents when needed.

DEVtrust offers AI and ML solutions for businesses, integrating natural language processing with seamless platform integration. This gives institutions a reliable way to support users at scale while keeping service costs under control.

Investment Portfolio Optimization

Managing an investment portfolio means tracking many variables. These include economic indicators, asset performance, global events, and personal financial goals. Human advisors working manually cannot adjust portfolios in real-time or identify every connection.

Machine learning enhances portfolio management’s adaptability. It processes inputs like interest rates, inflation trends, geopolitical changes, and commodity prices. Based on this data, the portfolio allocations are adjusted daily using real-time risk analysis.

For example, an ML system might detect that a drought in Brazil will lead to higher coffee prices. This could affect consumer spending and impact retail stocks. A human advisor may overlook this chain of events. The algorithm will not.

These models also personalize strategies. They factor in age, income, financial goals, and risk tolerance to build portfolios that aim for both growth and stability. As the market shifts, the model updates the strategy to match.

Stock Market Forecasting

Stock markets generate millions of data points each day. Traders historically relied on technical charts, earnings reports, and instincts. But this approach can’t match the speed or depth required today.

Machine learning models, especially deep learning architectures, aggregate structured and unstructured data, including price movements, macroeconomic indicators, and social sentiment. They detect patterns that correlate with market direction.

JPMorgan’s LOXM, for example, processes multiple data streams to execute trades in microseconds. It reacts to breaking news faster than a human can read the headline, assesses potential market impact, and adjusts trades accordingly.

The key is continuous learning. As market conditions evolve, the model updates its parameters, reducing exposure during periods of volatility and identifying inefficiencies in calmer periods. This maintains high performance across various market cycles.

Cybersecurity Enhancement and Employee Training

Cyber attacks on financial institutions have increased since 2020. Attackers now use tactics that traditional rule-based security systems often miss. The threat is not limited to outsiders; insider risks and social engineering targeting employees are just as serious.

Machine learning-based cybersecurity platforms create behavioral baselines for users, devices, and transactions. They flag unusual activity that may signal a threat. These systems scan millions of events simultaneously, accurately distinguishing harmless anomalies from real attacks.

Greenhill Investment Bank offers a clear example. After adopting CrowdStrike’s machine learning platform, the bank reduced false alerts by 75 percent and uncovered threats that had gone undetected before. The system continually learns from each incident, improving its accuracy and response speed over time.

Machine learning also strengthens employee training. It powers personalized simulations based on each employee’s specific vulnerabilities. These targeted phishing tests improve awareness and reduce risky behavior. Training content is adjusted based on performance and current threat trends, ensuring it remains both relevant and practical.

Personalized Financial Recommendations

Banks traditionally used demographics, such as age, income, and job title, to target product offers. But this leads to irrelevant messaging and missed opportunities.

Machine learning improves targeting by analyzing customer behavior, financial patterns, and interaction history. Instead of guessing who might need a product, the system identifies real signals, such as increased savings, spending shifts, or indicators of life events.

For example, if a user’s transaction history consistently shows high balances and reduced expenses, the system may recommend an investment product. Timing is optimized too, and offers are triggered when users are most likely to act, based on prior engagement data.

The system tracks which offers are accepted or ignored, learning which formats (email, app push, SMS) work best for each individual. This adaptive loop increases product uptake and customer satisfaction.

Loan Default Prediction

Traditional credit scoring relies on data from credit bureaus. This leaves out millions of people without established credit histories. Young adults, immigrants, and others may be creditworthy but remain invisible to standard scoring systems.

Machine learning provides a more effective way to evaluate credit. It adds alternative data to the risk assessment process. These systems review bank transactions, utility payments, job history, and even how individuals complete forms. When combined with traditional data, this creates a more complete view of the borrower.

ZestFinance is one example. Its platform examines thousands of alternative data points to identify reliable borrowers that older models may miss. Using this approach, lenders approved 15 percent more loans while maintaining steady default rates. Many approved borrowers had been excluded before.

Some ML systems also monitor borrower behavior after the loan is issued. They can detect signs of financial stress before a payment is missed. Lenders use this early warning to offer assistance, such as adjusted plans or financial advice. The models also utilize external data, such as unemployment rates and economic shifts, to keep their risk analysis current.

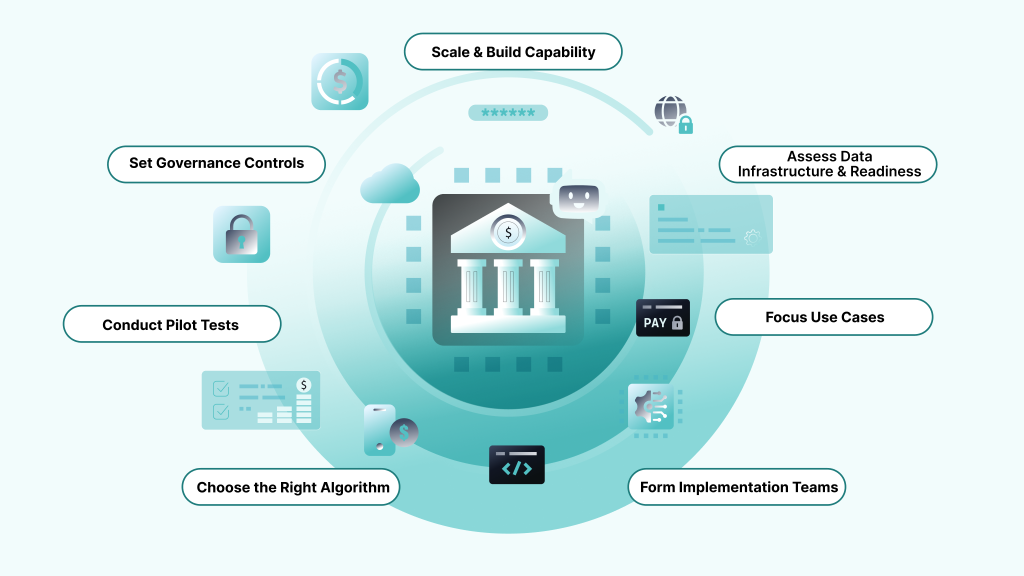

Machine Learning Implementation Steps in Banking

Banks planning to adopt machine learning must consider decisions regarding infrastructure, talent, and execution. A straightforward, phased approach helps reduce risks and ensures every effort ties back to measurable business value.

Step 1: Assess Data Infrastructure and Readiness

Machine learning outcomes are only as reliable as the data powering them. Banks must begin by evaluating the integrity, availability, and compliance of their data systems.

- Audit existing systems: Find broken data flows, missing links, or storage issues across departments.

- Assign ownership and access: Define who is responsible for managing data quality, version control, and team access.

- Ensure scalability and compliance: Ensure your systems can grow while still meeting regulatory requirements.

- Address data quality issues promptly: Remove outdated, duplicate, or incomplete records before incorporating them into models.

Step 2: Prioritize High-Impact Use Cases

Not every banking problem requires machine learning. Initial deployments should focus on areas with high ROI and measurable success.

- Target Structured, Data-Rich Processes: Use cases like fraud detection, credit scoring, and document automation work well early on.

- Quantify Value: Tie each use case to a tangible outcome, loss reduction, operational efficiency, or approval speed.

- Avoid Complexity for Its Own Sake: Choose problems where machine learning outperforms existing rule-based systems.

- Engage Stakeholders: Validate the use case with input from compliance, operations, and business teams.

Step 3: Build Cross-Functional Implementation Teams

Cross-functional execution is crucial to ensure that ML models effectively solve real-world problems and are successfully deployed in production.

- Assemble Balanced Teams: Combine data scientists, ML engineers, product leads, and compliance stakeholders.

- Foster Alignment from Day One: Embed collaborative workflows that reduce handoffs and miscommunication.

- Use Shared Success Criteria: Agree on what success looks like for the business, not just the model, early on.

Step 4: Choose the Right Algorithm

The choice of algorithm affects compliance, interpretability, and operational performance. Banks must weigh trade-offs before deployment.

- Match the algorithm to the task: Use decision trees or logistic regression for functions that require transparency, such as credit scoring. Select neural networks or gradient boosting for complex, high-volume problems, such as fraud detection or churn prediction.

- Test for fairness and bias: Check how each model performs across customer groups and locations to avoid unintended discrimination.

- Make the model explainable: Use tools like SHAP or LIME to show how the model makes decisions. The decision will help in both internal review and regulatory compliance.

- Validate in real-world settings: Test the algorithm in various production environments to ensure it performs reliably across all environments.

Step 5: Run Controlled Pilots to Prove Value

Pilots help validate ideas under real-world conditions while minimizing risk. A strong pilot reduces confusion and accelerates future rollouts.

- Narrow the Scope: Focus on one channel, product, or region to keep testing manageable and effective.

- Set Baseline Metrics: Define clear success thresholds, accuracy, turnaround time, or loss rates.

- Monitor and Iterate: Track pilot performance, document bottlenecks, and refine the model where needed.

- Design a Post-Pilot Path: Prepare a production rollout plan before the pilot concludes.

Step 6: Establish Governance and Risk Controls

Machine learning must meet regulatory expectations and ethical standards from the beginning. Governance is a core design pillar.

- Implement Model Validation Processes: Include independent testing, audit documentation, and fairness evaluations to ensure the model’s accuracy and reliability.

- Deploy Real-Time Monitoring: Use dashboards to detect drift, data anomalies, and performance degradation.

- Prioritize Transparency: Make model decisions explainable enough to satisfy both business and regulatory needs.

- Protect Data and Ethics: Secure customer information, prevent discriminatory outcomes, and comply with all privacy mandates.

Step 7: Scale What Works and Build Institutional Capability

A successful pilot means nothing if it cannot be repeated. Long-term success depends on standardizing what works and integrating it into the bank’s operations.

- Standardize ML Pipelines: Reuse model code, deployment processes, and monitoring tools across teams.

- Create Centers of Excellence: Build dedicated internal units that provide ML guidance, training, and compliance oversight.

- Invest in Upskilling: Offer ML training for business teams, product managers, and IT staff.

- Utilize Feedback Loops: Incorporate real-world results to refine future models and drive ongoing improvement.

If you are still unsure of how to move from pilot to full-scale implementation, the most effective next step is to bring in experts who can build, validate, and scale the solution for you. Book a strategy call to get clear guidance tailored to your business.

How DEVtrust Builds Reliable Machine Learning Solutions

Reliability in machine learning requires more than model accuracy. DEVtrust builds systems that deliver consistent, explainable results under production conditions, with precise alignment to business outcomes.

Each engagement begins with a focused assessment of objectives, workflows, and risks. Data quality, infrastructure readiness, and expected impact are validated before development commencement. This ensures the foundation supports both immediate performance and long-term scalability.

The team uses an iterative process. They prototype in controlled environments, train models with production-like data, and test against real-world edge cases. A model is deployed only after it has proven stable under load and meets operational needs.

DEVtrust works with a modern AI stack. This includes OpenAI, Azure OpenAI, LangChain, Google Vertex AI, and Pinecone. Each tool is carefully selected for its long-term maintainability, security, and performance. The team delivers solutions across document intelligence, predictive analytics, and conversational tools. Every implementation is built for resilience and flexibility.

After deployment, DEVtrust sets up continuous monitoring and performance checks to ensure ongoing stability. They run controlled retraining cycles to maintain model accuracy over time. The team also builds in documentation, audit trails, and compliance checks. This structure keeps models reliable and easy to manage.

Conclusion

Machine learning is transforming the way financial institutions operate. It enhances fraud detection, strengthens credit risk models, improves customer engagement, and streamlines compliance processes. The organizations that treat it as a core capability are seeing tangible gains in accuracy and efficiency.

Successful implementation depends on more than technology. It requires deep domain knowledge, technical precision, and a clear understanding of regulatory demands. DEVtrust brings all three, delivering machine learning systems that are stable, secure, and built for long-term value.

To move forward with purpose, reach out to DEVtrust and explore how applied AI can address the specific challenges in your organization.

Machine Learning in Banking: Key Use Cases and Implementation

Discover how machine learning in banking enhances fraud detection, personalizes experiences, boosts revenue growth, and automates compliance. Click to delve deeper into key uses and impacts.

Contact Us