The insurance industry is undergoing a major shift, and much of that change is happening on mobile. Customers now expect quick access to their policies, faster claim resolutions and clearer communication. Insurers, meanwhile, want more automation, lower operating costs and deeper insight into customer behavior. Mobile apps bring these needs together by providing secure, convenient digital experiences for both sides.

Accenture reports that 61% of insurance executives say rising expectations have pushed them to adopt mobile technologies sooner than planned. Insurers that prioritize mobile-first, self-service experiences are already seeing higher satisfaction and stronger engagement.

This guide explains what a modern insurance app needs, how the insurance mobile app development process works, and what to consider before choosing a partner.

Key Takeaways

- Mobile apps are now essential because customers expect faster claims, instant policy access and smooth communication, while insurers need automation and better insights.

- A good insurance app requires secure onboarding, policy management, digital claims, payments, notifications and scalable integrations like AI, IoT and telematics.

- Costs, compliance rules (HIPAA, GDPR), legacy systems and security have a major impact on how the app is built.

- The right development partner matters. DEVtrust offers insurance expertise and strong engineering to build secure, reliable, future-ready mobile apps.

Why Insurance Companies Need Mobile Apps Today

Mobile has become the primary channel for managing financial services, and insurance is no exception. Customers expect fast access to information, smoother claims and simple communication. A well-designed app helps insurers meet these expectations while improving efficiency across their operations.

- Rising Customer Expectations: People now compare plans, upload documents and track claims directly from their phones. Studies show that 74% of insurance customers have their carrier’s app installed, and frequent app users report higher satisfaction. Mobile-first flows like instant document upload, eKYC, in-app policy comparison and push-based claim updates directly improve satisfaction and retention.

- Better Customer Experience: An insurance app allows users to manage policies, file claims, upload documents and make payments without delays or paperwork. This level of convenience builds trust and encourages long-term loyalty.

- Higher Operational Efficiency: Automating onboarding, endorsements, renewals and claims reduces time spent on paper forms, email back-and-forth and call-centre follow-ups. Straight-through processing (STP) for simple claims, automated document checks and pre-configured workflows for approvals cut handling time from days to minutes. It is why 78% of top-performing life insurers now offer self-service digital portals.

- Stronger Competitive Advantage: The InsurTech market is projected to reach $32.47 billion by 2029. Mobile apps help insurers stand out in a crowded market where digital convenience is a key differentiator.

- Smarter Decision-Making: Mobile apps provide real-time behavioral data that improves underwriting accuracy, supports personalization and helps identify risks earlier.

Not every insurance customer has the same needs, though. Different segments rely on mobile apps for different reasons, which shape how these apps should be designed.

Types of Insurance Apps and Who They Serve

Insurance mobile apps cover a wide range of user needs. Each category focuses on solving problems specific to its segment.

1. Health Insurance Apps

Health insurance apps help users manage their medical coverage and access healthcare services online. Common features include:

- Viewing policy details and renewing coverage

- Booking doctor appointments

- Telemedicine consultations

- Wearable device integration for health monitoring

- Access to digital health records

2. Auto Insurance Apps

These apps support drivers with policy management, claims and on-road safety. They typically offer:

- Telematics-based driving analysis

- Instant claim filing with photo and video uploads

- 24/7 roadside assistance

- Premium payments and renewals

- Access to policy and vehicle documents

3. Life Insurance Apps

Life insurance apps simplify long-term planning and policy maintenance. Key features include:

- Premium calculators based on age, lifestyle and health

- Tools for comparing different life insurance plans

- Easy beneficiary or nominee management

- Automated reminders for premium payments

- Easy access to policy documents

4. Property and Home Insurance Apps

These apps help users protect homes, buildings and personal belongings. They often include:

- Damage reporting with photos

- Smart home device integration

- Property-based coverage customization

- Secure document storage

- Alerts and renewal notifications

5. Travel Insurance Apps

Designed for travelers, these apps offer quick coverage and emergency support. Features usually include:

- Instant policy purchase for immediate coverage

- Emergency assistance for lost luggage, cancelations and medical needs

- Flight and weather alerts

- Easy access to digital insurance documents

- Quick claim filing during emergencies

6. Business Insurance Apps

These apps help companies manage commercial policies and risks. They support:

- Selection of tailored insurance packages based on business size

- Fast claim submission for losses or fraudulent incidents

- Cost reduction by automating covered event settlements

- Centralized access to policy documents and renewals

Understanding these app categories makes it easier to see their real-world impact and how they enhance the insurance experience across different user groups.

Also Read: Hybrid Mobile App Development: A Beginner’s Guide

Key Benefits of Insurance Mobile Apps

Modern insurance apps do more than shift paperwork to a screen. They improve how customers interact with insurers while helping companies operate more efficiently. The advantages span both sides of the relationship.

For Customers

- 24/7 Access and Self-Service: Users can compare plans, buy policies, manage accounts and access documents anytime. They no longer depend on office hours, which gives them more control over their coverage.

- Personalized Policy Suggestions: Smart recommendations based on user behavior, driving patterns or health data help customers choose plans that match their needs without confusion.

- Better Communication and Engagement: Renewal reminders, premium alerts, claim updates, and in-app education keep users informed and reduce missed deadlines.

- Faster Claims and Quick Settlements: Digital FNOL flows let users capture photos/videos at the scene, attach police reports or medical bills, and submit everything in one guided journey. On the backend, rules engines and AI models can flag simple claims for straight-through approval, route suspicious ones to fraud teams and auto-generate settlement estimates. The result: fewer follow-up calls, fewer missing documents and faster payouts.

For Insurance Providers

- Higher Retention and Stronger Loyalty: A smooth mobile experience encourages customers to stay with their insurer. Easy renewals and timely communication help build long-term relationships.

- Lower Operational Costs: Automating claims, onboarding and customer support reduces manual effort and lowers call-center and branch expenses.

- Real-Time Analytics and Risk Insights: Every app session generates signals: logins, quote requests, coverage changes, telematics data, wearable stats and claim activity. When this data is pushed into a central data platform or lakehouse, actuaries and product teams can refine pricing, identify high-risk behaviours (e.g., hard braking, late-night driving), measure feature usage and test new product ideas with real cohorts instead of static assumptions.

- Better Fraud Prevention and Compliance: AI systems can detect unusual claim patterns. Audit trails and built-in compliance checks help insurers meet regulations like GDPR or HIPAA.

A strong insurance app improves experience, boosts efficiency and strengthens trust on both ends. Now that we’ve covered the benefits, let’s look at the features required to deliver them.

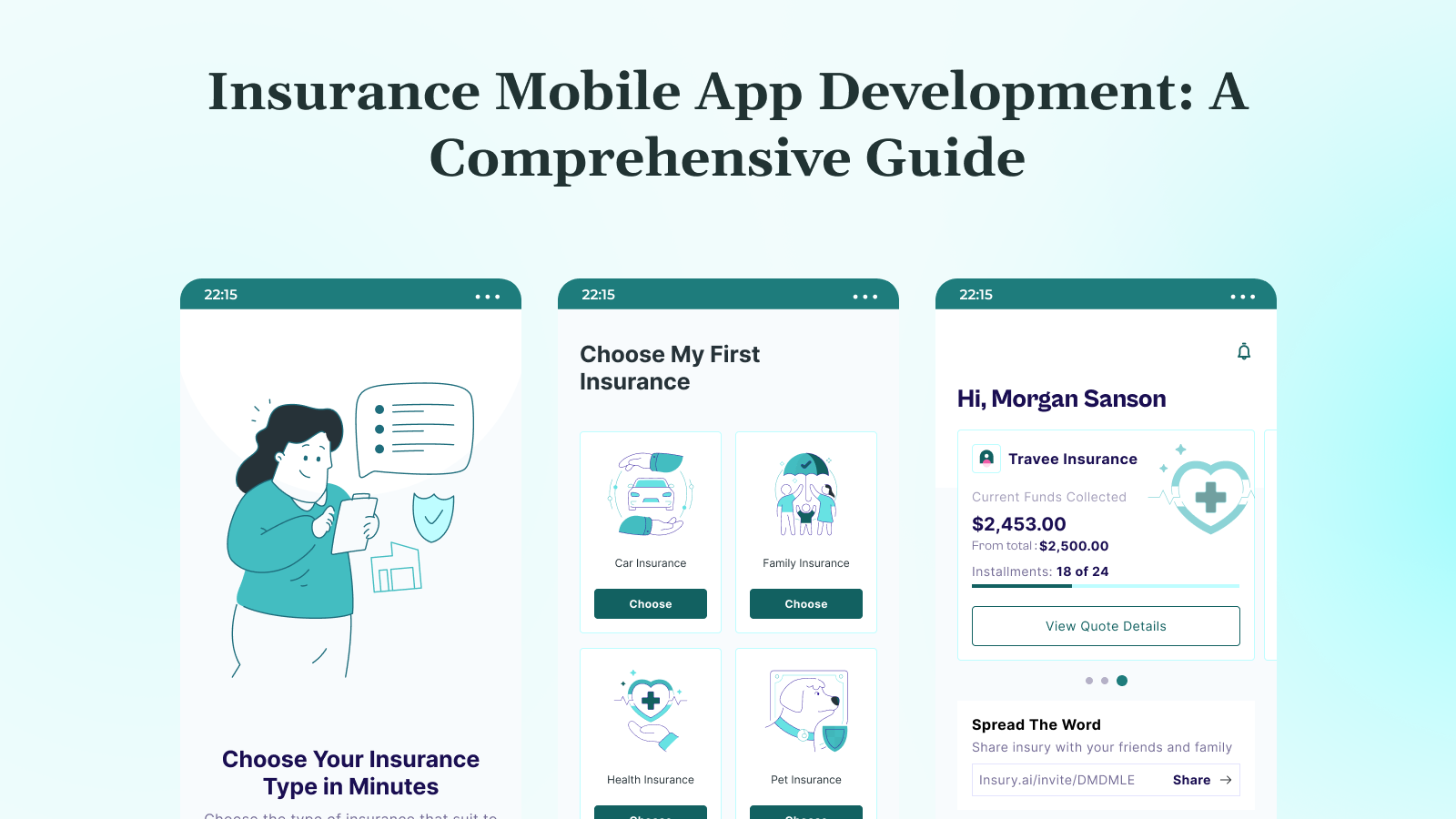

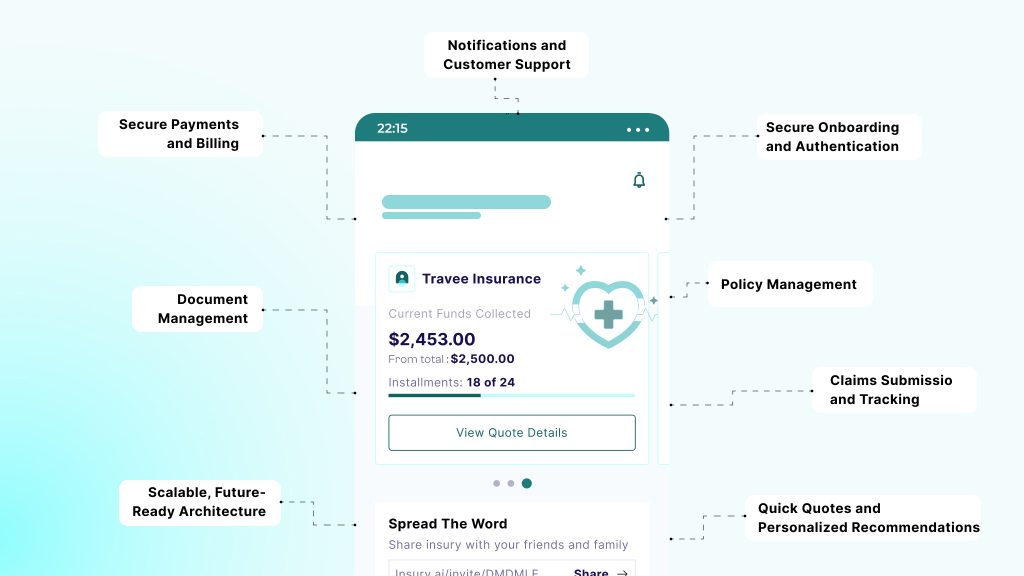

Essential Features of a Modern Insurance App

A modern insurance app should simplify everyday tasks for customers while supporting secure, reliable operations for insurers. The features below cover both the user experience and the technical backbone needed to run the app effectively.

1. Secure Onboarding and Authentication: Onboarding typically includes identity verification (eKYC), policy lookup and enrolment. The app should support OTP-based verification, strong passwords, biometric login (Face ID / fingerprint) and MFA, with all auth tokens managed via secure standards like OAuth 2.0 and JWT. For group or corporate plans, SSO (SAML/OIDC) ensures employees can access coverage with their existing credentials.

2. Policy Management: Customers should be able to view, update and renew policies, purchase new plans and download documents directly from the app. This reduces dependence on agents and makes policy management easier.

3. Claims Submission and Tracking: Claims should be handled as a guided workflow rather than a long form. The app can pre-fill policy details, ask dynamic questions based on claim type (auto accident, property damage, hospitalization), allow photo/video upload, geo-location, document scanning, and then show status changes like “Submitted → Under Review → Approved → Paid” in real time. Push notifications keep customers updated without needing to call a hotline.

4. Quick Quotes and Personalized Recommendations: Instant quote generation, clear policy explanations and data-driven recommendations guide users toward the right coverage without confusion.

5. Secure Payments and Billing: The app should support cards, ACH/net banking, digital wallets and auto-debit based on due dates. Integration with PCI DSS-compliant gateways, tokenized card storage and 3D Secure flows helps reduce fraud. In-app billing history, downloadable receipts, missed-payment alerts and reinstatement flows reduce policy lapses and inbound calls.

6. Document Management: A secure document vault gives users easy access to policy papers, ID cards, medical records, vehicle documents and claim files, all stored safely in one place.

7. Notifications and Customer Support: Renewal reminders, claim updates and premium alerts keep users informed. In-app chat, virtual assistants and live agent support help resolve issues quickly.

8. Scalable, Future-Ready Architecture with Integrations: Under the hood, a modern insurance app should be backed by API-first, microservices or modular architecture. Core systems (policy admin, billing, claims, CRM) should be exposed through secure APIs so the app can plug into telematics platforms, IoT sensors, health wearables and partner ecosystems without rewrites. Config-driven product rules and rating engines make it easier to launch new policy types or adjust coverage based on regulatory changes.

These features create meaningful value for customers and help insurers build stronger, long-term relationships. With features in mind, let’s explore the right technology stack to bring the app to life.

If you’re planning to build an app with these capabilities, partnering with a team like DEVtrust can help you translate these benefits into a polished, reliable product.

Tech Stack to Build a Reliable Insurance Mobile App

Choosing the right technology stack is essential for building a secure, compliant, and high-performing insurance app. Beyond UI, the stack has to support audit trails, encryption, complex rating logic, document-heavy workflows, and long-lived policies.

The tools below are commonly used in modern insurance development and support strong security, scalability, and a smooth user experience.

| Component | Recommended Technologies |

| Frontend | React Native or Flutter for cross-platform developmentSwift for iOS appsKotlin for Android apps |

| Backend | Node.js for fast, scalable server-side developmentPython frameworks like Django for clean, secure backend logicRuby on Rails for rapid application development |

| Database | PostgreSQL for structured dataFirebase for real-time data and authentication needsMongoDB for flexible, document-based storage |

| Security | OAuth 2.0 for secure authorizationAES encryption for safeguarding sensitive dataJWT for token-based user authentication |

| AI & ML | TensorFlow for building predictive modelsOpenAI tools for intelligent automation or chat featuresIBM Watson for chatbot and NLP-driven interactions |

| Cloud Hosting | AWS for scalable cloud infrastructureGoogle Cloud for data and AI-friendly hostingMicrosoft Azure for enterprise-grade cloud services |

| Payment Gateway | Stripe for global card paymentsPayPal for fast digital transactionsRazorpay for markets that require regional payment support |

| Third-Party APIs | Twilio for SMS and notification servicesPlaid for secure financial data verificationTelematics APIs for usage-based insurance and vehicle tracking |

This stack supports secure development, smooth performance and future-proof scalability, giving insurers the foundation needed to build and grow their mobile ecosystem.

Before moving ahead, it is important to understand the budget factors involved in building an insurance mobile app.

How Much Does Insurance App Development Cost?

The cost of an insurance mobile app depends on the complexity of its features, the number of system integrations and the level of security and compliance required. Apps focused on basic policy management sit on the lower end, while platforms with AI, telematics, advanced automation or legacy-system integration require a larger investment.

Key Factors That Influence Cost

- Number of insurance lines supported (auto, health, property, life)

- Complexity of the claims workflow

- Integrations with policy administration systems, CRMs and ERPs

- Compliance requirements such as HIPAA, GDPR or PCI-DSS

- AI, telematics or IoT capabilities

- Platforms required (iOS, Android or web)

- UI/UX design depth

- Data analytics and reporting requirements

- Localization and multi-region deployment

Most insurers start with an MVP that includes secure onboarding, policy viewing, premium payments, basic FNOL and notifications. This lets them validate adoption, measure app engagement and test operational readiness (claims, support, IT) before investing in advanced capabilities like telematics, wellness programs, dynamic pricing or embedded insurance APIs.

Cost, however, is only one part of the equation. Insurance apps also have to meet strict compliance and security requirements, which influence every development decision.

Security and Compliance Requirements You Must Follow

Insurance apps handle highly sensitive personal, financial and medical data. Because of this, compliance and security must be built into the product from the start, not added later.

Key Regulatory Requirements

Depending on the insurance segment and the regions served, developers must align with frameworks such as:

- HIPAA for protecting health-related data

- PCI DSS for secure handling of payment information

- SOC 2 for demonstrating strong operational and data-handling controls

- GDPR when serving or storing data of EU/EEA residents

- State-specific regulations covering disclosures, audit trails, data retention and telematics approvals

These rules dictate where data can be stored, how long it must be retained, who can see it and what protections are mandatory (encryption, access logging, breach notifications). They influence everything from cloud region selection and logging strategy to how you design consent screens. Once these requirements are mapped, you can safely plan the development process and system architecture.

Step-by-Step Process to Build an Insurance App

Building an insurance mobile app requires careful planning, strong security and strict adherence to industry regulations. The steps below outline a structured approach for creating a reliable, market-ready product.

Step 1: Market Research and Competitor Analysis

Identify your target users: individuals, businesses or niche segments. Review existing apps to spot gaps and gather feedback on what customers expect from a digital insurance experience.

Step 2: Define App Goals and Core Features

Decide the primary purpose of the app, such as policy servicing, claims, support or sales. List must-have features like biometric login, digital claims, policy customization and secure payments. If needed, include advanced capabilities such as AI risk scoring, telematics or wearable integrations.

Step 3: Plan for Compliance and Security

Map all data flows: what PII/PHI is collected, which systems it touches, where it’s stored and who can access it. Apply end-to-end encryption (in transit and at rest), design role-based access control, and ensure logs capture key events for audits (logins, policy changes, claim updates).

Align your architecture and processes with frameworks such as GDPR, HIPAA, PCI DSS and SOC 2 where relevant, and enforce MFA for customer, agent and admin access.

Step 4: Design a User-Friendly UI/UX

Create an intuitive interface that works for users of all ages. Provide clear dashboards for customers, agents and administrators. Consider options like dark mode, larger text sizes and voice assistance to improve accessibility.

Step 5: Development and API Integrations

Implement core modules (onboarding, policy servicing, claims, billing) and integrate with policy admin systems, billing platforms, CRMs, document management systems and payment gateways.

For health and auto, this may include telemedicine providers, TPAs, telematics platforms and IoT sensors. Design integrations as reusable services so you can plug in or swap vendors later without changing the app UI.

Step 6: Testing and Quality Assurance

Test across a defined device and OS matrix and validate critical flows: quotes, premium calculations, coverage selection, FNOL, document upload, payments and renewals.

Include negative tests (invalid inputs, expired cards, duplicate claims), load tests for peak periods (renewal season, major events), and security tests for vulnerabilities like insecure storage or weak session handling. Each release should go through a regression suite before reaching app stores.

Step 7: Deployment and Ongoing Support

Publish the app on iOS and Android. Offer a simple onboarding experience so users understand key features. Keep the app updated with regular improvements, security patches and new enhancements.

A structured process helps reduce risk, but insurers still face unique challenges during development. Addressing these early makes a significant difference.

Common Challenges in Insurance App Development

Insurance apps must balance security, compliance and usability, which brings a unique set of challenges. Addressing these early helps build a stable and future-ready product.

#1: Data Security and Privacy

Insurance apps handle highly sensitive personal and financial information, making them frequent targets for cyberattacks.

Solution: Use strong encryption, secure coding practices, identity management tools and regular security audits to protect data at every stage.

#2: Regulatory Compliance

Rules vary across states and insurance categories, and non-compliance can lead to serious penalties.

Solution: Bring compliance teams into the process early, map data flows clearly and apply region-based access controls to meet requirements such as HIPAA, GDPR and PCI-DSS.

#3: Legacy System Integration

Many insurers still rely on older core systems that are difficult to integrate with modern mobile apps.

Solution: Use middleware, APIs or microservices to bridge older systems. When APIs are not available, RPA can help. Modernization should be gradual to avoid operational disruption.

#4: Low User Engagement

Insurance isn’t used daily, so many users only open the app for renewals or claims.

Solution: Add features that provide ongoing value, such as reminders, claim updates, wellness tools and personalized recommendations. These keep users engaged throughout the year.

#5: Data Inconsistency

Insurance data often comes from multiple systems, which can lead to conflicting or outdated information.

Solution: Build a unified data model, create a central integration layer and add validation rules to keep data clean and consistent.

#6: Scalability and Performance

Traffic spikes during disasters or peak renewal periods can strain the system.

Solution: Use cloud-native architecture with auto-scaling, load balancing and caching to maintain steady performance even during high demand.

Working with a partner like DEVtrust helps you navigate these challenges with confidence, thanks to their proven experience in insurance technology and secure system design. Reach out to the team to learn more.

While these challenges are real, the industry continues to evolve. New technologies are reshaping what insurance apps can do.

Future Trends in Insurance Mobile App Development

Insurance apps are evolving quickly as new technologies reshape how insurers work and how customers manage their policies. The next wave of innovation focuses on speed, accuracy and preventive risk management.

- AI and Machine Learning: AI models now assist in triaging claims, extracting data from documents (IDs, invoices, medical reports), recommending coverage upgrades and predicting lapse risk. In mobile apps, conversational AI can guide users through FNOL, answer policy questions 24/7 and escalate complex issues to human agents with full context, reducing handling time and improving first-contact resolution.

- Telematics and IoT: Connected devices are becoming central to pricing and risk assessment. Auto insurers use telematics to understand driving behavior, while home insurers rely on sensors that detect fire, smoke or leaks early. This helps prevent losses instead of only covering them.

- Embedded Insurance: Insurance is increasingly offered inside travel apps, e-commerce platforms and fintech tools. This trend requires flexible APIs and mobile systems that can plug into partner platforms without friction.

- Blockchain: Blockchain adds transparency and security. It supports tamper-proof policy records, protects documents and simplifies claim verification, reducing disputes and delays.

- On-Demand Insurance: Short-term, pay-as-you-need policies are becoming more common. Mobile apps make it easy to activate temporary coverage for travel, gadgets, rentals or events, matching modern customer expectations for flexibility.

These trends show a clear shift from reactive servicing to proactive, technology-driven insurance models. They will continue shaping how insurers design and deliver mobile experiences.

Once you know what your app needs, it is important to find a partner who can execute it correctly.

How to Choose the Right Insurance Mobile App Development Partner

Insurance apps require technical depth and a strong grasp of regulations. When selecting a partner, look for:

- Domain experience: Look for teams who have worked with policy admin systems, rating engines, claims orchestration, TPAs, brokers and regulatory reporting. They should understand concepts like FNOL, endorsements, lapse/reinstatement, reinsurance and how these map to actual screens and workflows in the app.

- Proven delivery model: Full-cycle development, strong QA systems, and a clear communication process.

- Portfolio and success stories: Real work that reflects experience in insurance or other regulated sectors.

- Scalable engineering capabilities: Ability to support long-term product growth, complex integrations, and future innovation.

- Security-first approach: Strict policies for data handling, testing, and deployment.

A skilled, experienced partner reduces risk and accelerates your path to launch, especially in an industry where accuracy, compliance and reliability matter at every step. This is where DEVtrust stands out with its strong mix of insurance knowledge and engineering expertise.

Why DEVtrust Is the Right Choice for Insurance Mobile App Development

Building an insurance app demands more than software expertise. It requires a deep understanding of insurance workflows, compliance requirements and secure system architecture. DEVtrust brings these strengths together through an engineering-led approach tailored for insurers.

- End-to-End Expertise: From discovery and journey mapping to UX, architecture, development and QA, Devtrust designs flows for quotes, onboarding, endorsements, renewals, claims and billing that work for customers, agents and back-office teams.

- Security-Driven Design: Devtrust applies secure coding practices, encrypted data flows, hardened APIs and environment segregation, and can align solutions with frameworks like HIPAA, GDPR, SOC 2 and PCI DSS requirements based on your regulatory needs.

- Smooth Legacy Integration: Mobile apps are connected to core policy admin, billing and claims systems using integration layers, APIs and microservices, avoiding risky one-shot “big bang” replacements.

- AI and Automation Capabilities: Devtrust implements AI for document extraction, fraud signals, telematics analysis and next-best-action recommendations, turning raw data into operational decisions.

- Efficient Global Delivery Model: U.S.-based product stakeholders work with India-based engineering teams, using sprint-based delivery, shared tooling and overlapping hours to keep releases on track and transparent.

- Future-Ready Architecture: Modular designs and API-first principles make it easier to launch new products, embed insurance into partner apps and add capabilities like wellness programs or usage-based coverage over time.

DEVtrust helps insurers build secure, scalable and modern mobile platforms ready for long-term digital growth. Explore our case studies to see how similar projects have succeeded.

The Bottom Line

Insurance mobile apps are no longer optional. They’re where customers buy coverage, check benefits, file claims and decide whether to stay or switch. A well-built app simplifies policy management, claims and payments while giving insurers cleaner data, fewer manual touchpoints and better control over risk.

To build a secure and future-ready app, insurers need a partner who understands both technology and insurance. DEVtrust brings this depth of experience and supports every stage of insurance mobile app development, from planning to launch and ongoing improvements.

If you’re ready to build or upgrade your insurance mobile app, DEVtrust can help you create a solution that delivers real value for your business and your customers.

Ready to build your insurance mobile app? Contact us today to get started.