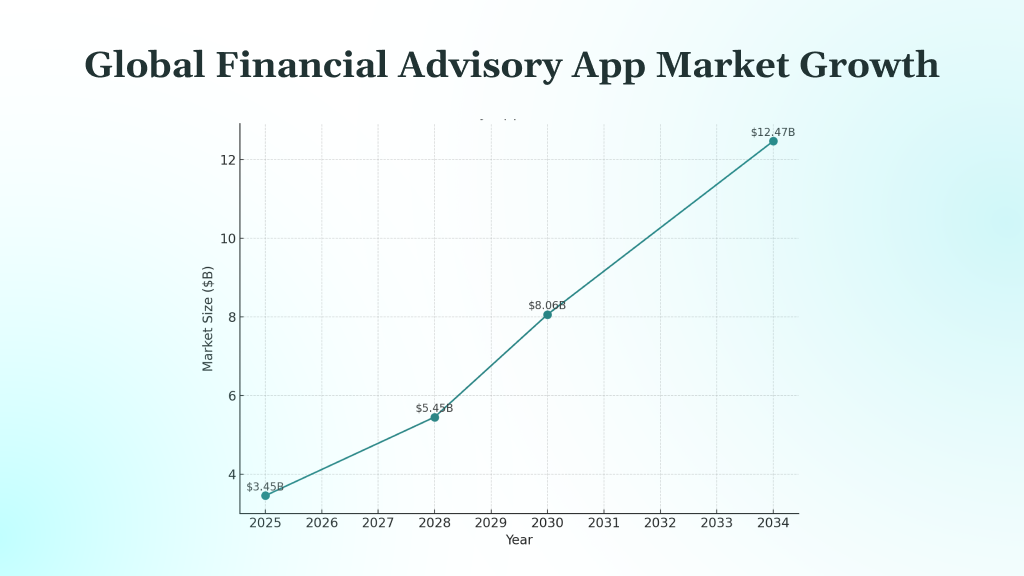

The financial advisory app market is expanding, with the global market size projected to grow from $3.45 billion in 2025 to $12.47 billion by 2034, reflecting a CAGR of 15.35%.

Smartphone adoption and the increasing digitization of financial services are driving this growth. In the US, over 70% of adults now use at least one financial advice app to manage their finances, investments, or budgets, signaling a shift in how Americans approach financial planning.

As financial needs grow, choosing the right financial advisory app can be overwhelming. Individuals and businesses are turning to digital solutions for real-time insights, personalized guidance, and easy integration with banking and investment platforms.

In this blog, we have compiled a list of the top financial advisors and wealth management apps, helping you choose the best solution for your financial needs.

Key Takeaways

- The financial advisory app market is on a strong growth path, with AI and digital adoption accelerating long-term demand.

- Top financial advice apps provide comprehensive budgeting tools, investment tracking, and personalized guidance.

- Security, regulatory compliance, and seamless integration are critical for user trust and app success.

- Emerging trends include AI-powered personalization, IoT integration, and gamification.

- DEVtrust provides end-to-end fintech development, from mobile apps to AI/ML and secure backend solutions, helping businesses innovate in the financial advisory space.

What to Look for in a Financial Advisory App?

Choosing the right financial advisory app involves more than just downloading the most popular option. The best app should align with your goals and integrate seamlessly with your financial ecosystem.

Here are key features to consider when selecting a financial advisory app:

1. Budgeting and Goal Tracking:

Tools like Mint or YNAB offer real-time insights, allowing users to plan their budgets and keep daily expenses aligned with long-term goals. Look for features like customizable budgets, expense categories, and visual progress trackers.

2. Investment and Wealth Management:

The best wealth management apps, such as Personal Capital and Wealthfront, offer portfolio analysis, automated investing, and retirement planning tools. These apps utilize algorithms to suggest asset allocations based on your risk tolerance, making investing more accessible for beginners.

3. Security and Compliance:

Ensure the app uses industry-standard security measures such as end-to-end encryption and multi-factor authentication. Apps should also comply with US financial regulations (e.g., SEC, FINRA), ensuring they are trustworthy and safe to use for handling sensitive data.

4. Integration Capabilities:

Top financial advisory apps connect easily with banks, credit cards, and third-party services via secure APIs like Plaid and Stripe. These integrations allow for automatic expense tracking, seamless transfers, and a comprehensive financial overview.

5. User Experience:

A clean, intuitive design, easy navigation, and accessible customer support are crucial for maintaining engagement. Look for apps with features like chat support, 24/7 availability, and tools for managing everything from investments to debt.

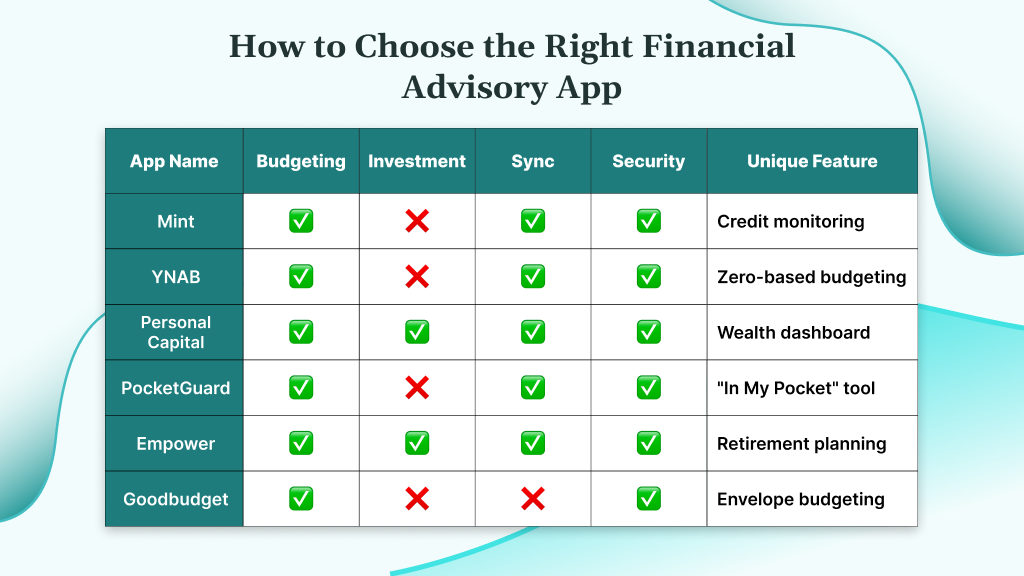

With these criteria in mind, let us examine the leading financial advice apps on the market.

Leading Financial Advisory Apps

The market for financial advisory apps is more competitive than ever, with established players and innovative newcomers vying for your attention. Here is an in-depth look at the best financial advisor apps and wealth manager apps for 2025.

1. Mint

Mint remains a top choice for individuals seeking a comprehensive view of their finances, providing detailed insights into budgeting, spending, and credit health.

- Automatic Expense Categorization: Mint syncs with your bank accounts and credit cards, automatically categorizing transactions. This helps users track expenses with minimal effort.

- Goal Setting and Alerts: Set savings goals for specific targets, such as emergency funds or vacations. Receive bill reminders and get alerts for unusual spending behavior.

- Credit Monitoring: Mint provides free credit score updates and personalized tips to help you improve your financial health.

- Integration: Supports connections with a wide range of US financial institutions, ensuring you get a unified and real-time overview of your finances.

2. YNAB (You Need A Budget)

YNAB is designed for proactive budgeters who prefer hands-on control over every dollar they earn.

- Zero-Based Budgeting: Assigns a purpose to each dollar, helping to eliminate wasteful spending and improve financial clarity.

- Real-Time Sync: Updates across devices make it ideal for families or partners looking to manage finances collaboratively.

- Educational Resources: Extensive tutorials, workshops, and a community of users provide ongoing financial education.

- Goal Tracking: Visualize progress toward savings, debt payoff, and financial goals, with clear indicators to stay on track.

3. Personal Capital

Personal Capital combines wealth management tools with financial advisory services, making it suitable for users who need investment guidance alongside budgeting tools.

- Investment Tracking: Get an in-depth view of your investment portfolio, including asset allocation and fees.

- Retirement Planner: Simulate different retirement scenarios and plan for future financial goals.

- Net Worth Dashboard: Track all your assets and liabilities in one place, offering a comprehensive view of your financial health.

- Wealth Management Services: Access personalized financial advice from certified planners to help optimize long-term financial goals.

4. PocketGuard

PocketGuard is perfect for users who want simplicity without sacrificing the functionality of advanced budgeting.

- “In My Pocket” Feature: This feature shows your actual spending power after setting aside money for bills, savings, and financial goals.

- Automatic Categorization: PocketGuard automatically categorizes your spending to help you stay within budget.

- Savings Goals: Easily set aside funds for specific purposes like vacations or emergency savings.

5. Empower

Empower, previously known as Personal Capital, focuses on comprehensive financial planning with a robust investment suite.

- Advanced Analytics: Dive deep into your spending, savings, and investment performance to understand how your money is working for you.

- Retirement Planner: Plan for long-term goals with detailed projections that help you estimate your future needs.

- Security: With military-grade encryption and multi-factor authentication, Empower ensures your financial data remains secure.

6. Goodbudget

The app modernizes envelope-style budgeting, letting users split their income into digital categories for smarter money control.

- Envelope System: Allocate funds to virtual envelopes for different categories like groceries, transportation, and entertainment.

- Cross-Platform Support: Sync budgets across iOS, Android, and web to keep all devices up to date.

- Family Sharing: Collaborate with family or partners on managing shared expenses and financial goals.

Now that you are familiar with the leading apps, let us explore key factors to consider when selecting the best financial advisory app for your needs.

How to Choose the Right Financial Advisory App

With numerous options available, selecting the right financial advisory app comes down to your personal or business needs. Let us look at some of the key factors to guide your decision:

1. Customer Support and Education

A financial advisory app is only as effective as the support it offers. Look for apps that provide:

- Responsive Customer Support: Availability through multiple channels like chat, email, or phone. Apps like Personal Capital and Mint provide strong support for users with technical or financial questions.

- Educational Resources: Many apps offer in-app guides, webinars, and learning resources to help users improve their financial literacy. Apps like Acorns and Betterment provide content that helps new users learn more about investing and saving.

2. Fees and Pricing Transparency

While most financial apps are free, others charge for premium features or wealth management services. Consider:

- Transparent Fees: Apps like Wealthfront and Betterment are upfront about their management fees. It is essential to understand how much you will be paying, whether through monthly subscriptions, management fees, or transaction costs.

- Free vs. Paid Features: Some apps offer free basic functionality but charge for advanced features. Ensure you know what you will get with a free plan vs. what comes with paid plans.

3. Data Aggregation and Tracking

Look for apps that offer data aggregation for a broader financial view.

- Comprehensive Financial View: Check for apps that allow users to connect various financial accounts, including checking accounts, loans, and credit cards, so all your financial data can be monitored in one place.

- Investment Performance Tracking: Some apps go beyond just portfolio tracking to provide insights into how your investments are performing against benchmarks.

4. Tax Planning and Reporting

For users looking for tax optimization, some apps integrate tax planning features:

- Tax Optimization: Apps like TaxSlayer and TurboTax integrate with financial advisory apps to provide tax-saving advice, deductions, and tracking. Users who are actively investing or have complex financial situations may benefit from this feature.

- Tax Reporting: Some apps generate reports to help with tax filing, which can make the year-end process easier for individuals who need to report income from multiple streams.

5. User Reviews and Ratings

Consider reading reviews from credible sources like the App Store or Google Play:

- Real User Feedback: Reviews can provide insights into usability, customer service quality, and any hidden fees or limitations. Apps with high ratings and positive reviews, such as YNAB and Empower, are often better received by users.

- Third-Party Reviews: Websites like NerdWallet or Investopedia provide comprehensive reviews and comparisons, which can help you evaluate whether an app suits your financial goals.

6. Scalability and Future Updates

Lastly, think about how the app will evolve as your financial situation changes:

- Scalability: Will the app scale as your financial needs grow? Apps like Mint or Personal Capital are great for individual users but may also support more complex needs over time as they add more features.

- Continuous Updates: Make sure the app you choose is updated regularly with new features, security enhancements, and bug fixes. Look for apps with a track record of continuous improvement, which regularly update their app to match changing market conditions and financial tools.

With the right criteria in mind, it is also important to stay updated on the latest trends shaping the future of financial advisory apps.

Key Considerations for Financial Advisory Apps

When it comes to financial advisory apps, security and compliance are essential to ensure that users’ data is protected and the app adheres to regulatory standards. Here is what to look for:

Security and Compliance

- End-to-End Encryption: Financial data should be encrypted both in transit and at rest, preventing unauthorized access to sensitive information.

- Multi-Factor Authentication (MFA): MFA provides an additional layer of security, ensuring that only authorized users can access their accounts.

- Regulatory Compliance: Trusted apps comply with US regulations, including standards set by FINRA, SEC, and state-level requirements, to ensure legal and operational transparency.

- Data Privacy: Apps should have clear privacy policies that outline how user data is collected, stored, and managed, with mechanisms for user consent management.

Integration Capabilities

Effective financial advisory apps do not operate in isolation. They need to integrate seamlessly with other platforms to enhance the user experience and provide a comprehensive financial ecosystem.

- Bank and Payment Processor APIs: Leading apps integrate with Plaid, Stripe, and Yodlee to securely aggregate data from banks and manage payments.

- Investment Platforms: Integration with brokerage APIs, such as Yahoo Finance and QuickBooks, allows real-time portfolio tracking and investment management.

- Automation Tools: Support for Zapier and Make.com enables users to automate tasks like syncing expenses with spreadsheets and setting up alerts.

DEVtrust specializes in API integration and scalable cloud solutions, helping fintech companies connect their financial advisory apps to the broader financial ecosystem, improving both functionality and user engagement.

As trends evolve, understanding how these innovations impact the industry can help you choose a future-proof app.

Emerging Trends in Financial Advisory Apps

The financial advisory app market is evolving, shaped by technological innovation and changing user expectations. Here is what is new in 2025:

1. AI-Powered Personalization

AI-powered tools are transforming financial advisory apps by providing personalized recommendations tailored to individual goals and financial data.

- Tailored Investment Strategies: AI analyzes user behavior and preferences to automatically optimize investment portfolios.

- Predictive Analytics: Apps predict market trends and suggest actions to users based on their financial goals and risk tolerance.

- Examples: Wealthfront and Betterment utilize AI to offer automated portfolio management, enabling users to invest according to their needs without requiring manual adjustments.

2. IoT Integration

Integrating IoT devices into financial apps allows users to track their spending in real-time, gaining insights through connected wearables and smart devices.

- Real-Time Expense Tracking: Syncs with smartwatches and other IoT devices to give users live updates on their spending.

- Alerts & Notifications: Sends real-time notifications when a user is nearing a budget limit or has exceeded their spending limit.

- Examples: Mint integrates with smartwatches to track spending and goals on the go, giving users an up-to-date overview of their finances.

3. Voice Assistants and Chatbots

Voice assistants and chatbots are revolutionizing the way users interact with financial apps, enabling them to gain insights and manage their finances more intuitively.

- 24/7 Availability: Users can receive financial advice or request real-time updates via voice commands or text.

- Instant Support: Chatbots help resolve queries, manage tasks, and assist with budgeting, making the financial process smoother.

- Examples: Cleo, a financial chatbot, offers conversational money management, enabling users to track expenses and set budgets effortlessly.

4. Gamification

Gamification features within financial apps encourage better user engagement by making financial management more interactive and rewarding.

- Savings Challenges: Users can set savings goals and compete with themselves or others to meet targets, making their financial journey more engaging and rewarding.

- Rewards for Milestones: Apps offer incentives, such as cash back or rewards, when users achieve financial goals, motivating them to stay on track.

- Examples: Qapital turns savings into a game by allowing users to set custom savings rules and earn rewards as they meet financial milestones.

5. Open Banking

The rise of open banking is transforming how financial apps connect with third-party services, offering users more choices and flexibility.

- Seamless Data Sharing: Open banking enables users to securely share their financial data with apps for more accurate budgeting and investment advice.

- Expanded Financial Ecosystem: Integration with services like credit cards, loans, and investments broadens users’ access to financial products.

- Examples: Plaid and Yodlee enable financial apps to link seamlessly with bank accounts and other financial institutions, creating a unified platform for managing all financial needs.

These trends are not only enhancing user experience but also driving greater adoption of financial advice apps across demographics.

How DEVtrust Supports Financial App Innovation

Building a standout financial advisory app requires deep technical expertise and industry insight. DEVtrust delivers end-to-end solutions for fintech innovators:

- Custom Mobile App Development: From ideation to deployment, DEVtrust crafts secure, scalable mobile apps tailored to your business needs.

- API Integration: Seamlessly connect your app to banks, payment processors, and investment platforms.

- AI/ML Capabilities: Use artificial intelligence for personalized financial advice and predictive analytics.

- UI/UX Excellence: Intuitive, accessible interfaces designed for maximum engagement.

- Case Studies: Explore how DEVtrust has empowered neo-banks, wealth-tech platforms, and payment processors to launch innovative products with real-time trading dashboards and AI-driven financial chatbots.

Ready to build your next financial advisory app? Book a free consultation with DEVtrust to explore your options.

To Wrap Up

The financial advisory app market in 2025 is more dynamic than ever. With robust budgeting, investment, and wealth management features, today’s best financial advisor apps empower users to take control of their financial futures.

As technology continues to evolve, integration, security, and personalization will remain at the forefront of innovation. For businesses seeking to launch or enhance their financial advice app, DEVtrust offers the expertise and solutions needed to succeed in this competitive market.

Explore DEVtrust’s custom fintech development services to bring your vision to life. Connect with us today!

Top Financial Advisory Apps for Budgeting and Planning 2025

Explore the top financial advisory apps for budgeting and planning. Discover features, trends, and expert tips to choose the best financial advisor app.

Contact Us