Every business, no matter its size, depends on how well banks operate; truly, the banking system is the backbone of every industry. Banking software is essential because it supports every transaction, customer interaction, and financial decision worldwide.

From the earliest online banking systems to the integration of advanced analytics, technology has completely reshaped how financial services are provided and utilized.

The main goals for banking software projects are many-sided. They aim to make operations much more efficient, significantly improve the customer experience, ensure strong security, meet strict regulations, and ultimately, help the business grow.

Key takeaways

- Banking software is essential for all financial transactions and bank operations in today’s digital world.

- It helps banks automate tasks, gain quick insights, and ensure secure money transfers, becoming a core part of the industry.

- Developing this software involves a structured process (SDLC) using key tech like AI, cloud, and robust security.

- Strong security is critical due to rising cyber threats, with strict regulations guiding development.

- Choosing the right development partner is key to staying competitive and innovative in this changing financial landscape.

What is Banking Software Development?

Banking software development involves creating, launching, and managing software applications specifically for the financial industry. This encompasses a broad spectrum of solutions, from core banking systems that manage fundamental operations to sophisticated platforms for fraud detection and personalized financial advice.

This software is crucial because it automates complex banking tasks, provides instant data insights, and ensures secure, seamless financial transactions. It has become a core component of the financial industry’s operations.

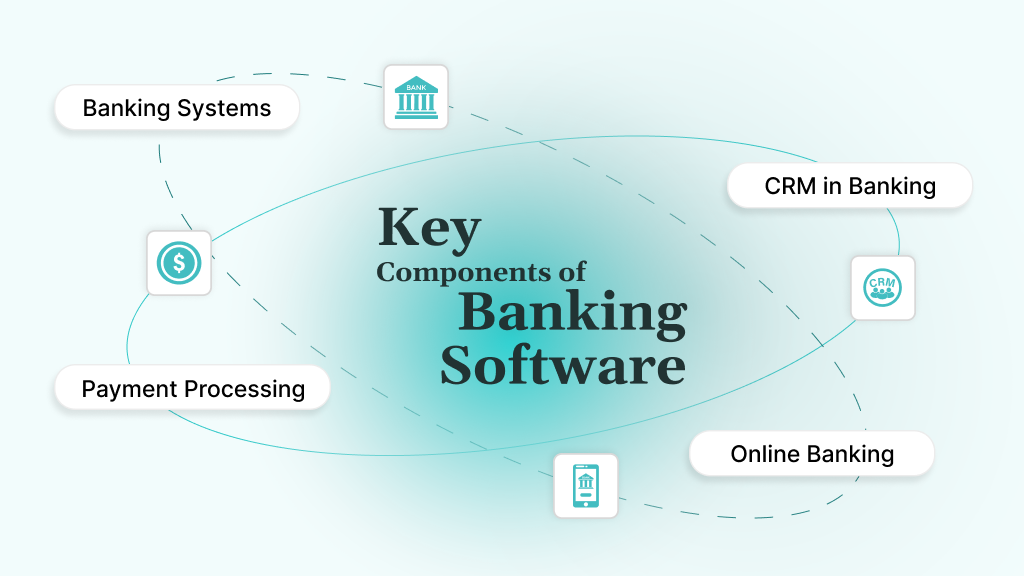

Key Components of Banking Software

Modern banking software solutions are intricate ecosystems comprised of several interconnected components, each serving a crucial function:

Core Banking Systems

These are the foundational systems that manage essential banking operations, including account management (deposits, withdrawals, loans), transaction processing, ledger maintenance, and interest calculations. They are the central nervous system of any financial institution.

Customer Relationship Management (CRM) in Banking

CRM systems are vital tools that enable banks to manage customer data and interactions effectively. With this information, banks can personalize services and improve customer satisfaction, ensuring they remain loyal.

Mobile and Online Banking Platforms

These platforms provide customers with convenient access to their accounts and banking services through web browsers and mobile applications. They enable activities such as fund transfers, bill payments, account balance checks, and loan applications, offering a seamless digital experience.

Payment Processing Systems

Facilitate secure transactions by using payment gateways, employing encryption protocols, and implementing real-time authorization mechanisms that connect banks, businesses, and customers to ensure transaction security and efficiency.

Security and Fraud Detection Features

Because financial data is highly sensitive, robust security is essential. This involves utilizing encryption, multi-factor authentication, biometric checks, and innovative tools to detect and prevent fraud.

Types of Banking Software

Different types of banking software exist, all created to meet specific demands in the financial world. These include:

- Retail Banking Software: Solutions for individual customers, including savings accounts, checking accounts, personal loans, and credit cards.

- Corporate Banking Software: Platforms tailored for businesses, managing corporate loans, trade finance, cash management, and treasury operations.

- Investment Banking Software: Tools for managing portfolios, trading, risk analysis, and financial modeling for investment activities.

- Lending Software: Systems dedicated to the entire lending lifecycle, from loan application and origination to servicing and collection.

- Wealth Management Software: Applications for financial advisors to manage client portfolios, provide investment advice, and plan for long-term financial goals.

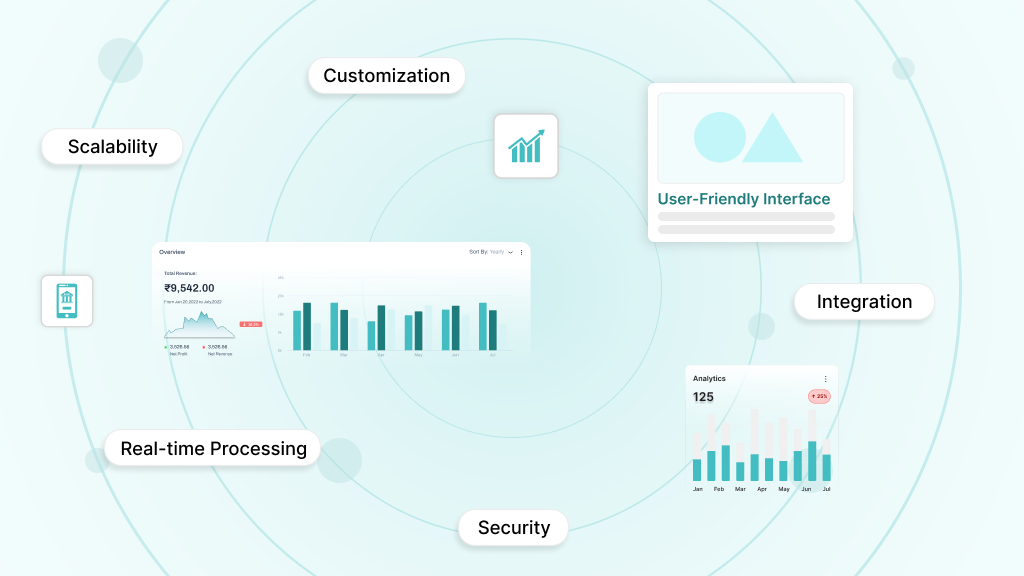

Key Features of Banking Software

Effective banking software typically incorporates a range of features that contribute to its efficiency, security, and user-friendliness:

- Scalability: Ability to handle increasing volumes of transactions and users.

- Integration Capabilities: Smoothly connects with existing systems and third-party applications.

- Robust Security: Advanced encryption, fraud detection, and compliance with security standards.

- User-Friendly Interface: Simple design that works well for both customers and bank workers.

- Real-time Processing: Instantaneous processing of transactions and data updates.

- Reporting and Analytics: Tools for generating financial reports and extracting actionable insights.

- Customization: Easily changes for different business needs and regulations.

Importance of Banking Software in the Financial World

In today’s fast-paced financial world, banking software is more important than ever. It enables financial institutions to:

- Enhance Customer Experience: Provide convenient, personalized, and efficient services.

- Enhance Operational Efficiency: Automate manual processes, minimize errors, and lower operational costs.

- Ensure Regulatory Compliance: Adhere to complex and evolving financial regulations to maintain compliance.

- Mitigate Risks: Execute robust security measures to protect against fraud and cyber threats.

- Drive Innovation: Foster growth and competitiveness by embracing new technologies and innovative business practices.

- Foster Competitiveness: Differentiate themselves in a crowded market by offering superior digital services.

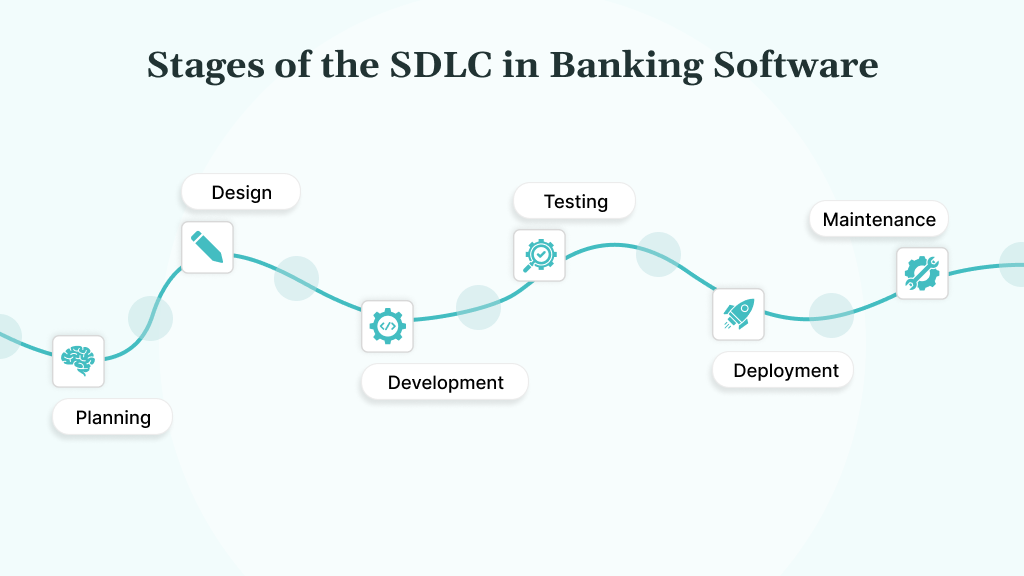

The Banking Software Development Process

Developing banking software is a complex undertaking that requires a systematic approach, leveraging appropriate technologies throughout its lifecycle. The Software Development Life Cycle (SDLC) provides a structured framework that guides financial institutions through the process from concept to deployment and beyond.

Stages of the SDLC in Banking Software

Each stage of the SDLC in banking software integrates technological choices and adherence to best practices to ensure robust, secure, and compliant solutions.

1. Planning and Requirement Gathering:

- Phase Focus: Defining project scope, objectives, and detailed functional and non-functional requirements (e.g., performance, scalability, security, regulatory compliance). This stage heavily involves understanding the business needs and the desired customer experience.

- Technology Considerations: Although not directly related to coding, this stage informs the initial technology choices. For instance, understanding a need for real-time payments might point towards microservices architecture and specific database types. Compliance requirements will dictate security framework considerations from the outset.

- Challenges & Solutions: Challenges include unclear requirements and scope creep. Solutions involve detailed documentation, frequent stakeholder communication, and prototyping to visualize concepts.

2. Design:

- Phase Focus: Architecting the software solution. This includes defining the system architecture, database design, user interface (UI), user experience (UX) design, and security architecture. The goal is to create a blueprint for the development team.

- Technology Considerations: This is where the chosen APIs and microservices architecture are planned out, defining how different components will communicate with each other. Decisions are made based on specific database management systems (e.g., relational systems like Oracle for transactional data, or NoSQL systems like MongoDB for flexible data) depending on the data volume, velocity, and variety. The security framework, including encryption protocols and access controls, is intricately designed here.

- Challenges & Solutions: Challenges can be scalability issues or complex integrations with legacy systems. Solutions include modular design, microservices patterns to avoid monolithic structures, and robust architectural planning to address integration complexities early.

3. Development / Implementation:

- Phase Focus: Writing and coding the software based on the design specifications. This is where the actual building takes place.

- Technology Considerations: Developers write backend logic, frontend interfaces, and database interactions using selected programming languages such as Java, Python, C++, C#, and JavaScript. This stage also includes building functionalities that apply Machine Learning algorithms for fraud detection and personalized services, as well as integrating Blockchain and Distributed Ledger Technologies for use cases like secure cross-border payments.

- Challenges & Solutions: Issues like coding errors, performance bottlenecks, and maintaining code quality. Solutions include rigorous code reviews, automated unit testing, and adherence to best coding practices and established coding standards.

4. Testing:

- Phase Focus: Rigorous testing to identify and fix bugs, ensure functionality, performance, and security. This phase verifies that the software meets all defined requirements and performs as expected under various conditions.

- Technology Considerations: Automated testing frameworks are employed. Performance testing tools simulate high transaction volumes to assess system performance accurately. Security testing tools conduct vulnerability scans and penetration tests to identify potential security risks. Where ML models are involved, their accuracy and bias are thoroughly tested.

- Challenges & Solutions: Ensuring comprehensive test coverage and identifying all defects. Solutions involve various testing types (unit, integration, system, user acceptance testing – UAT), extensive test automation, and dedicated performance and security testing teams.

5. Deployment:

- Phase Focus: Releasing the software into the production environment, making it available for use by customers and bank employees.

- Technology Considerations: Automation tools for deployment (part of DevOps practices) are critical here to ensure smooth, repeatable, and error-free releases. Cloud platforms offer flexible deployment options.

- Challenges & Solutions: Minimizing downtime and preventing deployment errors. Solutions include automated deployment pipelines, phased rollouts, and robust rollback strategies in case of issues.

6. Maintenance and Support:

- Phase Focus: Ongoing monitoring, updates, bug fixes, performance enhancements, and security patches. This continuous phase ensures the software remains secure, reliable, and up-to-date with evolving business needs and technological advancements.

- Technology Considerations: Continuous monitoring tools track system performance and security. Regular updates to underlying technologies (operating systems, libraries) are managed. New ML models may be deployed as customer behavior changes, and blockchain networks might require upgrades.

- Challenges & Solutions: Keeping up with evolving technology, security threats, and new regulatory requirements. Solutions involve proactive monitoring, scheduled updates and patches, and a dedicated support team for rapid incident response and ongoing enhancements.

Specific Methodologies Used

The “how” of moving through these stages can vary based on the chosen development methodology:

- Agile: An iterative and incremental approach that emphasizes collaboration, flexibility, and rapid delivery. It is often preferred for its adaptability to changing requirements, crucial in a dynamic financial landscape.

- Waterfall: A process where phases happen one after the other; you cannot start the next until the current one is done. While less flexible, it can be suitable for projects with obvious and stable requirements.

- DevOps: Practices that combine development and operations to speed up software creation and ensure constant, high-quality releases. This methodology heavily leverages automation of infrastructure, testing, and deployment, directly integrating many of the “Essential Technologies” into the SDLC flow.

Regulatory Compliance and Standards

The financial industry is one of the most heavily regulated sectors, making compliance a critical aspect of banking software development.

Role of regulatory bodies in banking software

Key US financial regulators – such as the Federal Reserve, OCC, FDIC, CFPB, and state banking agencies – create rules. These rules are designed to make sure the financial system is stable, has integrity, and is fair. They also require stringent measures for data security, privacy, anti-money laundering, and consumer protection.

Key regulations impacting software development

Here is the list of key regulations, adapted to be specific to the US financial landscape:

- GLBA (Gramm-Leach-bliley Act): This act requires banks to inform customers about data sharing and to secure sensitive personal information. It also includes the Safeguards Rule, which requires financial institutions to implement a comprehensive security program to protect customer information.

- PCI DSS (Payment Card Industry Data Security Standard): While not a direct US government regulation, it is an industry-mandated security standard enforced by major credit card brands. It ensures the secure handling of credit card information for all entities involved in payment processing within the US.

- Basel III (US Implementation): While a global framework, its principles are adopted and implemented by US regulators (Federal Reserve, OCC, FDIC) to set capital adequacy, stress testing, and liquidity risk standards for banks operating in the United States. This includes rules such as the Dodd-Frank Act’s Collins Amendment, which incorporated parts of Basel III into U.S. law.

- BSA (Bank Secrecy Act) / AML (Anti-Money Laundering) and KYC (Know Your Customer): The BSA is the most critical US law against money laundering. It enables banks to assist the government in identifying and preventing illegal money transfers and funding for terrorism. This includes filing Currency Transaction Reports (CTRs) for transactions over $10,000, Suspicious Activity Reports (SARs), and implementing robust Customer Identification Programs (CIP) as part of KYC processes. The USA PATRIOT Act further expanded these requirements.

- EFTA (Electronic Fund Transfer Act) and Regulation E: This federal law protects consumers engaging in electronic fund transfers (EFTs) in the US, including debit card transactions, ATM withdrawals, and online banking transactions. Regulation E, enforced by the CFPB, outlines disclosure requirements, error resolution procedures, and consumer liability limits for unauthorized transfers.

Best practices for ensuring compliance

- Privacy by Design: Incorporating privacy considerations into the software development process from the outset.

- Regular Audits: Doing frequent checks, both outside and inside the company, to make sure rules are being followed.

- Data Encryption: Encrypting sensitive data both in transit and at rest.

- Access Controls: Implementing strict access controls to limit who can access sensitive information.

- Continuous Monitoring: Establishing systems for constant monitoring of compliance status and reporting.

Security and Risk Management

Given the lucrative target that financial institutions present for cybercriminals, robust security and proactive risk management are non-negotiable.

Importance of cybersecurity in banking software

Cybersecurity in banking software uses layered defenses, such as strong encryption to protect data, strict access controls to limit unauthorized use, continuous system monitoring to detect anomalies, and advanced threat detection systems to identify and mitigate fraud attempts, thereby safeguarding data, preventing fraud, and ensuring service reliability. A single security breach can have devastating consequences, including significant economic losses, reputational damage, and legal penalties. For Context, in Q2 2024, check point research saw a 30% YOY increase in cyber attacks globally, This alarming trend underscores the critical need for advanced security in banking software.

Risk assessment and management strategies

- Threat Modeling: Identifying and pinpointing threats and vulnerabilities within the software.

- Vulnerability Scans and Penetration Testing: Regularly scanning for weaknesses and simulating cyberattacks to identify exploitable vulnerabilities.

- Incident Response Planning: Developing a clear plan for how to respond to and recover from security incidents.

- Employee Training: Educating bank employees on cybersecurity best practices and potential threats.

Tools and technologies for enhancing security

- Firewalls and Intrusion Detection Systems (IDS): Guarding networks against unauthorized users and malicious actions.

- Data Encryption: Securing data during transmission and storage.

- Multi-Factor Authentication (MFA): Adding layers of security beyond just passwords.

- Security Information and Event Management (SIEM) Systems: Analyzing security data to detect and respond to dangers quickly.

- Blockchain Technology: While still emerging, it offers potential for enhanced security and transparency in certain financial transactions.

Post-deployment support

Security is an ongoing process. Post-deployment support encompasses continuous monitoring, regular security updates, patch management, and prompt incident response to emerging threats.

Future Trends in Banking Software Development

New technology is bringing about significant changes in the banking industry. These changes are affecting everything, from how banks operate internally to the services they offer their customers.

Emergence of FinTech and its influence

FinTech (Financial Technology) companies are disrupting traditional banking by offering innovative, technology-driven financial products and services. This has pushed traditional banks to accelerate their digital transformation efforts, fostering collaboration and competition.

Integration of AI for personalized banking experiences

AI and machine learning analyze customer data patterns to deliver tailored financial advice, recommend products aligned with individual needs, and provide real-time assistance through intelligent chatbots, enhancing the overall banking experience.

The evolution of cloud computing in banking

Cloud computing enables banks to scale resources on demand, reduce infrastructure costs, and enhance data analytics capabilities, while hybrid and private clouds help address security and compliance requirements specific to the financial sector.

Choosing the Right Banking Software Development Partner

Seeking the right partner is crucial for the success of your financial software development project.

Key considerations when selecting a financial software development partner

- Industry Expertise: Look for a partner with proven experience and a proper understanding of the financial sector, its regulations, and industry best practices.

- Technical Proficiency: Assess their expertise in relevant technologies, programming languages, and development methodologies.

- Security and Compliance Focus: Ensure they prioritize cybersecurity and have a clear understanding of regulatory compliance requirements (GDPR, PCI DSS, etc.).

- Agile Development Capabilities: A partner proficient in Agile methodologies can adapt to evolving requirements and deliver solutions iteratively.

- Communication and Collaboration: Strong communication skills, combined with a collaborative approach, are essential for a successful partnership.

- Scalability and Support: Confirm their ability to scale teams based on project needs and provide ongoing maintenance and support.

- Reputation and Portfolio: Review case studies, client testimonials, and their portfolio of past projects to gage their track record.

How DEVtrust Can Help You in Banking Software Development

At DEVtrust, we combine deep financial industry knowledge with technical expertise to deliver tailored banking software solutions that address your unique business challenges and regulatory requirements.

We specialize in crafting advanced financial software solutions that drive efficiency, enhance security, and deliver exceptional user experiences:

- Custom Software Development: Building bespoke banking applications from scratch, precisely aligned with your business processes.

- Digital Transformation: Guiding financial institutions through their digital journey, modernizing legacy systems, and adopting innovative technologies.

- AI/ML Integration: Implementing intelligent solutions for fraud detection, risk management, predictive analytics, and personalized customer interactions.

- Cloud Solutions: Designing and deploying secure and scalable cloud-based banking platforms.

- Regulatory Compliance: Ensuring all developed software adheres to stringent industry regulations and security standards.

- System Integration: Seamlessly integrating new software with your existing IT infrastructure.

See how we have delivered impact: View our case studies.

Conclusion

The landscape of financial software development is dynamic and ever-evolving, driven by technological innovation and shifting regulatory requirements. Comprehensive banking solutions are no longer a luxury but a necessity, profoundly impacting customer satisfaction and operational excellence.

By embracing innovative technologies like AI, cloud computing, and robust security frameworks, financial institutions can boost efficiency, reduce risks, and provide personalized experiences that meet what modern customers expect. The future outlook for software development in the banking industry is bright, promising more secure, efficient, and intelligent financial services. To secure your competitive edge and realize your digital potential, contact DEVtrust now.

Banking Software Development: Comprehensive Solutions and Insights

Enhance your banking software development with key insights on core systems, security, AI integration, and compliance. Transform your banking solutions today!

Contact Us