Building a fintech product today means working through delays, fragmented systems, and compliance hurdles that slow execution. Most financial infrastructure was not designed for the speed or flexibility modern users expect.

For product teams, the real challenge is execution under pressure. Shipping secure, scalable software requires clarity in architecture, regulation, and experience. Every decision has a long-term impact.

This is where strong fintech startup ideas matter. When built around real pain points like credit access, faster payments, or embedded tools, they create clear and defensible value.

The blog outlines 15 fintech startup ideas that are well-positioned for 2025. Each section covers the core problem being solved, key product features that drive adoption, and real-world examples of companies executing successfully in that space.

Key Takeaways

- Fintech startup ideas succeed when they target clear, underserved financial problems with focused product scope and strong execution.

- API-driven infrastructure and compliance platforms now allow smaller teams to build complex financial tools without heavy upfront investment.

- Vertical fintech models, such as peer-to-peer lending, digital banking for freelancers, or industry-specific wallets, still have room for improvement in terms of positioning and product depth.

- Strong UX, regulatory alignment, and backend integration are not optional. They define long-term scalability and user trust.

- The 2025 fintech landscape favors specialization over disruption. Precision in the use case and audience is what drives product-market fit.

Why Fintech Startups Are Flourishing in 2025

Three significant changes are making fintech startups more successful than ever before. First, the rules became clearer. Regulators now have specific guidelines for digital banking, payment processing, and lending. This removes the legal uncertainty that previously scared away investors and entrepreneurs.

Second, the technology got cheaper and better. Building a banking app used to require millions in infrastructure. Now, cloud services and APIs let small teams build enterprise-grade financial software. You can process payments, verify identities, and manage compliance through existing platforms.

Third, people’s habits changed permanently. The pandemic pushed everyone online faster than anyone predicted. People who never trusted digital payments became comfortable with apps like Venmo and Cash App. Small fintech companies can now compete with big banks using intelligent algorithms instead of huge budgets.

The infrastructure layer matured, too. Services like Stripe, Plaid, and Twilio handle the complex backend work. This means fintech startups can focus on solving user problems instead of building payment rails from scratch.

List of Top 15 Fintech Startup Ideas

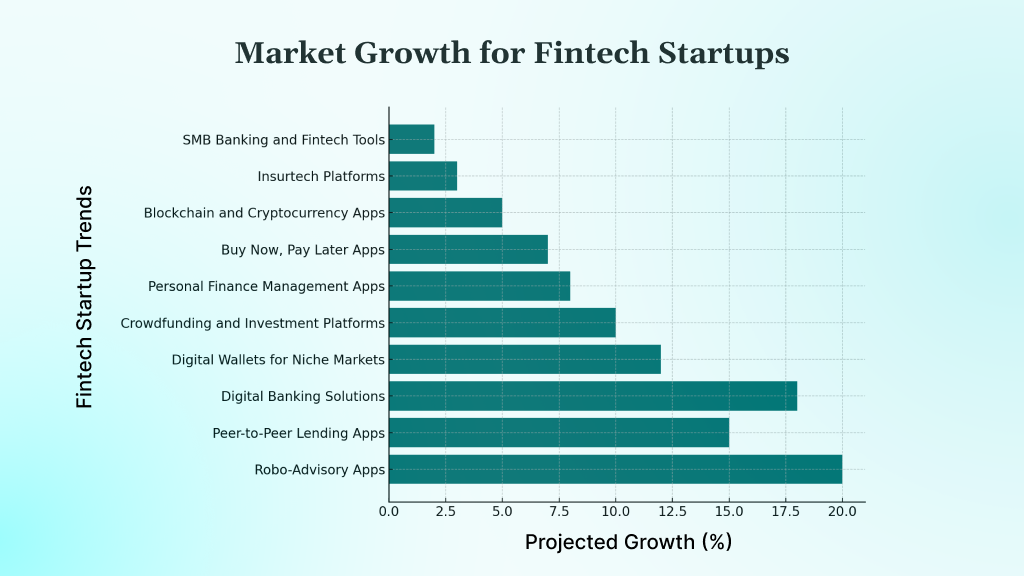

Fintech in 2025 is defined by specialization. Startups are shifting away from general-purpose apps and developing products centered on clear financial use cases, faster payments, simpler investing, more effective credit tools, and more innovative money management. Many of these ideas have already been proven but still have room for improvement, such as better execution, stronger technology, or more intelligent positioning.

Here are 15 fintech startup ideas worth pursuing to build a viable, high-growth business.

Robo-Advisory Apps

Robo-advisory apps use algorithms to manage investment portfolios automatically. Instead of paying a human financial advisor 1-2% of your assets annually, these apps charge 0.25-0.50% while providing similar services. They rebalance portfolios, harvest tax losses, and adjust risk in accordance with your goals.

Robo-advisory apps assess user responses to construct a portfolio aligned with their risk profile and monitor investments daily, automatically adjusting allocations to maintain balance and optimize returns. When stocks rise, it sells some and buys bonds to maintain its target allocation. The Hybrid Robo Advisors segment, which combines automated algorithms with human advisor input, is expected to reach $20 billion by 2030, driven by increasing demand for personalized yet affordable investment management.

Features to build

- Automated onboarding flow with KYC and dynamic risk assessment

- Portfolio generator based on risk profile and time horizon (ETF-based)

- Real-time portfolio rebalancing engine triggered by drift thresholds

- Tax-loss harvesting module with calendar-year reporting

- Goal tracking dashboard for retirement, emergency fund, and education

- Behavioral nudges that guide users during market dips or volatility

- User-friendly performance analytics (net return, asset allocation, benchmarks)

- Secure account aggregation (view all linked investment and retirement accounts)

- In-app support for Roth IRA, Traditional IRA, and 401(k) rollovers

Real-World Examples

- Betterment – One of the first US robo-advisors, managing over $60 billion in assets as of July 2025, with strong retirement planning tools

- Wealthfront – Targets high-income professionals with automated portfolios and cash management

- M1 Finance – Offers DIY investing with robo tools, fractional shares, and zero commissions.

- SoFi Invest – Combines robo-investing with student loan tools and member benefits.

- Fidelity Go – A low-fee robo product from a trusted legacy brand

Peer-to-Peer Lending Apps

Consumer borrowing habits are shifting fast. Credit cards often come with high rates and opaque terms, and traditional banks still reject borrowers using outdated underwriting practices. That gap is fueling the growth of peer-to-peer (P2P) lending, digital platforms that directly connect individual borrowers with investors.

Instead of banks acting as middlemen, P2P apps provide users with faster access to personal loans at lower rates. On the other side, individual investors earn better returns by funding diversified borrower portfolios. What makes this model viable in 2025 is its use of real-time data and machine learning to assess creditworthiness, reduce risk, and automate origination and servicing processes.

Features to Build

- Smart loan application flow with income checks, document uploads, and pre-qualification in minutes

- Automated credit decision engine using traditional + alternative data sources

- Investor dashboard with loan filters, risk grades, and diversification tools

- Secondary loan marketplace for early exits and liquidity

- Built-in repayments and auto-debit setup with missed payment alerts

- Secure messaging and notifications between borrowers and the platform

Real-World Examples

- LendingClub – Over $100 billion in loans issued as of April 2025, now operating as a fully digital bank

- Prosper – Focuses on personal loans for debt consolidation and home improvement.

- Funding Circle – Specializes in fast, low-friction loans to small businesses.

- Upstart – Uses AI-driven underwriting to approve borrowers that traditional banks decline.

Digital Banking Solutions

As traditional banks’ digital offerings remain outdated and slow to adapt, purpose-built digital banking platforms tailored to underserved segments with vertical-specific products and intuitive design create new opportunities.

New banking infrastructure enables the launch of full-service digital banks without requiring the development of everything from scratch. Sponsor banks handle compliance and FDIC coverage, while fintech teams focus on building differentiated user experiences, such as tax tools for freelancers, multi-currency accounts for global workers, or spend controls for startup teams.

Features to Build

- Instant account opening with KYC and ID verification

- Real-time transaction feed with intelligent categorization (e.g., food, rent, subscriptions)

- Auto-savings rules like round-ups and recurring deposits.

- No-fee peer-to-peer payments between users

- Early direct deposit access for payroll

- Spending analytics and budgeting tools with monthly summaries

- FDIC-insured balance protection and fraud alerts

- Multi-currency wallets (if targeting cross-border users)

Real-World Examples

- Chime – Serves over 12M users with fee-free checking and early payroll deposits.

- Current – Mobile bank for younger users with budgeting and rewards features

- Varo Bank – First consumer fintech to get a national US bank charter

- Revolut (US version) – Offers multi-currency accounts and cryptocurrency from a single wallet.

Digital Wallets for Niche Markets

Mainstream wallets like Apple Pay and Google Pay cover basic transactions, but they fail to support industries with more complex payment needs. That gap opens the door for niche wallets purpose-built for vertical use cases.

A healthcare wallet includes insurance card storage, copay automation, and provider integrations. In construction, features like subcontractor payments, retention tracking, and compliance reporting are essential. Restaurants require tools for distributing tips, offering loyalty rewards, and integrating point-of-sale systems.

Generic payment apps cannot serve these workflows. A niche wallet that aligns with real business operations becomes critical infrastructure, offering both defensibility and pricing power.

Features to Build

- Custom payment flows aligned with industry logic (e.g., split payments, copays, contractor disbursements)

- In-app storage for ID cards, insurance info, or licenses

- Direct integration with CRM or accounting systems (e.g., QuickBooks, Salesforce)

- Offline payment mode with background sync for field work or remote sites

- Multi-user roles and access permissions (e.g., admin, staff, contractors)

- Industry-specific receipts and exportable reports for tax, payroll, or compliance

Real-World Examples

- Toast – Built for restaurants, combining POS, payments, payroll, and loyalty

- Square – Designed for small businesses with industry modules for salons, retail, and food trucks

- Flywire – Focuses on high-value payments in healthcare, education, and travel.

- Tilled – Provides embedded payments infrastructure for SaaS companies targeting a vertical.s

Crowdfunding and Investment Platforms

Raising capital still depends heavily on who you know. Most early-stage founders do not have access to venture firms or high-net-worth angel networks. Crowdfunding platforms remove that barrier by connecting entrepreneurs directly with individual investors.

These platforms enable founders to publish their pitch, funding goals, and key metrics of traction. Investors can review opportunities and contribute capital in exchange for equity, early access, or other benefits. The platform handles investor onboarding, regulatory compliance, and ongoing communication.

This model unlocks funding for startups in second-tier cities, niche sectors, or underrepresented groups. It also opens up private investing to the general public, creating a two-sided market with significant long-term value. When executed well, crowdfunding platforms can earn revenue through listing fees and deal volume, making the model scalable and sustainable.

Features to Build

- Campaign creation flow, including pitch decks, video uploads, funding tiers, and legal documents.

- Investor verification based on accreditation status and regulatory requirements

- Automated investor updates with milestone tracking and monthly reporting.

- Secondary trading module for early liquidity (if allowed under Reg A or Reg CF)

- Escrow-backed payment system for safe fund transfers and disbursements

- Analytics dashboard for both founders and investors (funding progress, ROI, retention)

Real-World Examples

- Republic – Startup equity crowdfunding platform with due diligence and community perks

- Fundrise – Real estate investment app with $7 billion+ in AUM and low entry thresholds

- Kickstarter – Creative crowdfunding leader with $6 billion+ pledged since launch

- WeFunder – Reg CF platform enabling small startups to raise funds from unaccredited investors

Personal Finance Management (PFM) Apps

Most people struggle to manage their money effectively. PFM apps solve this by aggregating financial data across bank accounts, cards, and investments and then turning it into clear insights.

These apps track spending, auto-categorize transactions, forecast cash flow, and help users budget, save, and pay off debt. Features like bill reminders, savings goals, and investment tracking remove friction from day-to-day financial decisions.

Manual budgeting tools are often time-consuming and frequently overlooked. A well-designed PFM app delivers ongoing value with minimal user effort, making it highly sticky. For startups, this creates strong engagement, retention, and monetization potential through premium features or partnerships with financial institutions.

Features to Build

- Bank account aggregation with real-time balance syncing

- AI-based transaction categorization (e.g., food, bills, subscriptions)

- Monthly budget builder with auto-adjusting limits

- Bill calendar and payment reminders with snooze or auto-pay options

- Savings goals with progress bars and visual milestones

- Debt payoff planner using avalanche or snowball methods

Real-World Examples

- Mint – Links financial accounts, offers budgets, and free credit scores.

- YNAB (You Need A Budget) – Focuses on proactive zero-based budgeting

- Copilot – AI-driven PFM app with Apple-style UX for Gen Z users

- Personal Capital – Combines PFM and wealth tracking with financial advisor support.

Buy Now, Pay Later (BNPL) Apps

BNPL apps allow shoppers to split purchases into interest-free installments, typically over 4 to 12 weeks. These platforms integrate directly with e-commerce sites and in-store checkouts, offering quick financing at the point of sale.

They use soft credit checks supplemented with alternative data sources such as utility payments and online behavior to instantly assess creditworthiness, enabling quick spending limit decisions and automatic repayment scheduling. For merchants, BNPL drives higher conversion rates, larger order values, and better customer retention.

Traditional credit cards are costly and unclear. BNPL appeals to younger buyers who want simpler, short-term payment options. The model scales well across retail categories and offers strong monetization through merchant partnerships and transaction fees.

Features to Build

- Real-time credit approval at checkout using soft credit pulls or alternative data

- Check out integration modules for Shopify, WooCommerce, Magento, and custom APIs

- Auto-scheduled repayments with SMS/email reminders and in-app alerts

- Spending cap management with adjustable limits and repayment status

- Merchant dashboard showing approval rates, repeat usage, and sales uplift

- Dispute resolution and refund tracking for edge cases

Real-World Examples

- Affirm – Offers installment loans with transparent terms, used by Amazon and Peloton.

- Afterpay (by Block) – Popular among Gen Z, especially in fashion and lifestyle retail

- Klarna – Serves millions of users globally with flexible payment schedules and merchant tools.

- Sezzle – Focuses on credit-building BNPL for underserved users.

Blockchain and Cryptocurrency Asset Apps

Traditional finance tools cannot handle the pace or complexity of digital assets. Blockchain apps bridge that gap with simple access to crypto, DeFi, and asset management.

These platforms enable users to store tokens, trade assets, stake their holdings, and interact with DeFi protocols, all through a clean, mobile-first interface. Many also support multi-chain access, yield optimization, and automated portfolio strategies.

As blockchain adoption expands into payments, compliance, identity, and smart contracts, demand for usable apps is growing fast. Startups that hide the technical layers and solve for trust, UX, and security have room to scale.

Features to Build

- Multi-chain cryptocurrency wallet supporting Bitcoin, Ethereum, Solana, and Layer-2s

- In-app crypto trading with instant price quotes and order execution

- DeFi dashboard with lending, borrowing, staking, and APY tracking

- Cryptocurrency tax summary with auto-generated Form 8949 and gain/loss breakdown

- Automated portfolio tracking with real-time performance and rebalancing

- Multi-layer security using biometric login, multi-sig, and seed phrase backup

Real-World Examples

- Coinbase – Publicly listed, supports crypto trading, staking, and custody with SEC compliance

- MetaMask – Popular browser/mobile wallet enabling DeFi access via Ethereum and Layer-2s

- Kraken – US-based exchange offering cryptocurrency trading, futures, and staking

- Compound – A DeFi lending protocol that allows users to earn interest and borrow cryptocurrency

- Zerion – Aggregates wallet, DeFi, and NFT data into a single interface for active users

Insurtech Platforms

Insurance is still stuck in a world of phone calls, paper claims, and delayed payouts. Insurtech startups are transforming the industry with real-time underwriting, AI-powered claims processing, and digital-first policies.

By combining machine learning, IoT, and computer vision, these platforms assess risk more accurately and process claims in minutes. Many offer usage-based pricing models, embedded coverage at the point of need, and self-serve policy management.

It is a high-friction industry with massive inefficiencies, making it a ripe space for well-designed digital tools that enhance the customer experience while reducing operational costs.

Features to Build

- Instant quote and policy issuance with AI-based underwriting

- Digital claims filing with photo upload, real-time tracking, and instant approval for small claims

- Usage-based pricing (e.g., mileage tracking, wearables, behavior-driven auto/home rates)

- Self-service dashboard for updating coverage, beneficiaries, and documents

- In-app support bot for claims, billing, and policy questions

- Integration with health or auto IoT devices for risk monitoring

Real-World Examples

- Lemonade – Offers renters, homeowners, and pet insurance with AI claims and fixed-fee pricing

- Root Insurance – Provides auto insurance with pricing based on driving behavior via smartphone tracking

- Oscar Health – Health insurance platform with virtual care, claims transparency, and app-first support

- Next Insurance – Tailors small business insurance with instant quotes and online policy management

SMB Banking and Fintech Tools

Small businesses face financial complexity that generic banking tools rarely address. Fintech platforms tailored for SMBs offer automated invoicing, payroll, cash flow forecasting, and embedded lending wrapped into one modern interface.

These solutions often integrate directly with tools like QuickBooks or Xero, simplifying tax reporting and expense tracking. With features like real-time account visibility and flexible credit access, they help SMBs operate with the clarity and control larger enterprises take for granted.

This segment remains underserved by traditional banks, making it a strategic market for fintech builders.

Features to Build

- Business checking accounts with instant setup and no minimums

- Automated invoicing and collections with reminder workflows

- Cash flow forecasting based on incoming receivables and payables.

- Integrated payroll and contractor payouts with automated tax filings

- Working capital loans with non-traditional credit scoring

- Multi-user permissions for finance teams and bookkeepers

Real-World Examples

- Brex – Offers business banking, credit cards, and spend management for startups.

- Mercury – Digital banking platform for tech-first startups with developer APIs

- Ramp – Corporate card + spend control platform with advanced finance automation

- NorthOne – Mobile-first business banking with invoicing and real-time cash insights

E-Mortgage and Real Estate Finance Platforms

Traditional mortgage processes are slow, paper-heavy, and expensive. E-mortgage platforms fix this by automating loan origination, property valuation, and closing, cutting timelines from 45+ days to under 20.

These platforms integrate with MLS data, digital signature tools, and valuation APIs to streamline the borrower journey. Applicants can upload documents, obtain approvals, and track their status through a single interface. Lenders benefit from faster processing and lower operational costs.

With housing demand rising and buyers expecting digital-first experiences, the space is primed for disruption.

Features to Build

- Digital loan applications with automated document uploads and ID verification

- Real-time property valuation using MLS data and machine learning models

- In-app loan tracking with milestone notifications and document requests

- eClosing support with secure e-signatures and remote notary options

- Mortgage rate personalization based on soft credit pull and income insights

- Investor dashboard for mortgage-backed securities and performance tracking

Real-World Examples

- Rocket Mortgage – End-to-end digital mortgage with same-day approval and eClosings

- Better.com – Direct-to-consumer platform offering fast loans, refinancing, and real-time rates

- Blend – Lending infrastructure used by banks like Wells Fargo for mortgage origination

- loanDepot – Offers paperless loan processing with instant income verification.

Trading and Micro-Investing Platforms

Micro-investing platforms lower the barrier to entry for participating in the stock market. By offering fractional shares, zero commissions, and automation, they let users start investing with as little as $1.

Key features, such as round-up investing, dollar-cost averaging, and social trading, appeal to first-time investors. Educational modules simplify financial literacy, building long-term user engagement.

With Gen Z and millennials demanding accessible wealth-building tools, this model offers strong growth potential, especially for founders targeting mobile-first, underserved retail investors.

Features to Build

- Fractional share investing with automatic dividend reinvestment

- Automated round-up investing from spare change or recurring transfers

- Social investing tools with user profiles, portfolios, and leaderboards

- Goal-based portfolios with adjustable risk and timeline options

- Interactive education center with quizzes, tutorials, and performance insights

- Zero-commission trades with real-time execution and order history.

Real-World Examples

- Robinhood – Pioneered zero-commission trades with easy access to stocks, ETFs, and crypto

- Acorns – Automates investing through spare change round-ups and pre-built portfolios

- Stash – Combines micro-investing with financial education, banking, and goal tracking.

- Public – Offers commission-free trading with social feeds and long-term investing tools.

Real-Time Payroll and Earned Wage Access (EWA)

EWA platforms provide workers with instant access to earned wages, eliminating the need to wait for payday. These apps sync with payroll and time-tracking systems to calculate and distribute wages in real time.

They solve cash flow stress for hourly workers while helping employers reduce turnover and increase retention. Features like instant transfers, payout limits, and financial wellness tools enhance long-term value.

As demand grows for fair pay practices and on-demand income, EWA remains a timely, scalable startup model with direct B2B and B2C monetization paths.

Features to Build

- Live wage tracking synced to time worked and hourly pay.

- Instant cash-out to debit cards, wallets, or linked bank accounts

- Employer integration with payroll and time systems like ADP or Workday

- Employee dashboard with next payout estimate, usage history, and transfer limits

- Financial wellness add-ons like budgeting tools, savings nudges, or bill-tracking

- Customizable employer controls (limits, access rules, analytics)

Real-World Examples

- DailyPay – Used by Walmart and McDonald’s for early wage access and shift-based payouts

- Earnin – Offers fee-free wage advances with optional tips and financial tracking tools.

- Branch – Combines EWA, budgeting, and no-fee checking accounts for hourly workers

- Payactiv – Offers EWA, savings goals, bill pay, and financial wellness features.

Embedded Finance Infrastructure for Marketplaces

Embedded finance enables marketplaces and platforms to offer services such as payments, lending, and insurance natively without requiring them to become banks themselves. Using APIs and white-label tools, businesses can build financial features directly into their product workflows.

This infrastructure reduces friction for end users and opens new monetization channels for platforms. Instead of redirecting users to third-party providers, financial services become part of the experience.

As financial regulation becomes more developer-friendly and customer expectations continue to rise, this model offers high scalability and long-term enterprise value.

Features to Build

- White-label payment processing with vendor split and payout scheduling

- Lending features like invoice financing or working capital loans

- Built-in insurance workflows based on transaction-level triggers

- Embedded compliance tools (KYC, KYB, AML) during onboarding

- Partner dashboards for revenue tracking, disbursement logs, and payouts

Real-World Examples

- Stripe Connect – Used by Shopify and Lyft to power embedded payments and split payouts.

- Unit – Full-stack banking APIs for checking accounts, cards, and lending

- Synapse – Embedded finance infrastructure used for cards, cryptocurrency wallets, and KYC flows

Credit Builder Platforms for Thin-File Users

Credit builder platforms are designed for people with little or no traditional credit history, often referred to as “thin-file” users. These apps offer secured cards, small installment loans, and rent-reporting tools to help users build credit step by step.

They work by integrating with alternative data sources, such as utility payments, mobile bills, and bank activity, to generate credit signals. Some platforms also offer coaching and real-time credit monitoring to guide user behavior.

With millions of underserved users excluded from mainstream lending, this model opens a fast-growing and socially impactful market, ideal for long-term retention and user trust.

Features to Build

- Secured card programs with graduation to unsecured after consistent repayment

- Rent and utility reporting to all major credit bureaus (Experian, Equifax, TransUnion)

- Micro installment loans that build history while saving small amounts monthly

- In-app credit score monitoring with personalized tips for improvement

- Gamified credit goals and milestone achievements to drive user engagement

- Financial literacy modules tailored to new-to-credit users

Real-World Examples

- Self – Offers credit builder loans and reports monthly payments to all three bureaus

- Chime – Provides a no-fee secured credit card with auto-pay features and instant score impact.

- Petal – Uses bank data to issue credit cards to those without a traditional credit history.

- Kikoff – Offers credit lines that report on-time payments to boost scores.

Trends in the Fintech Industry for 2025

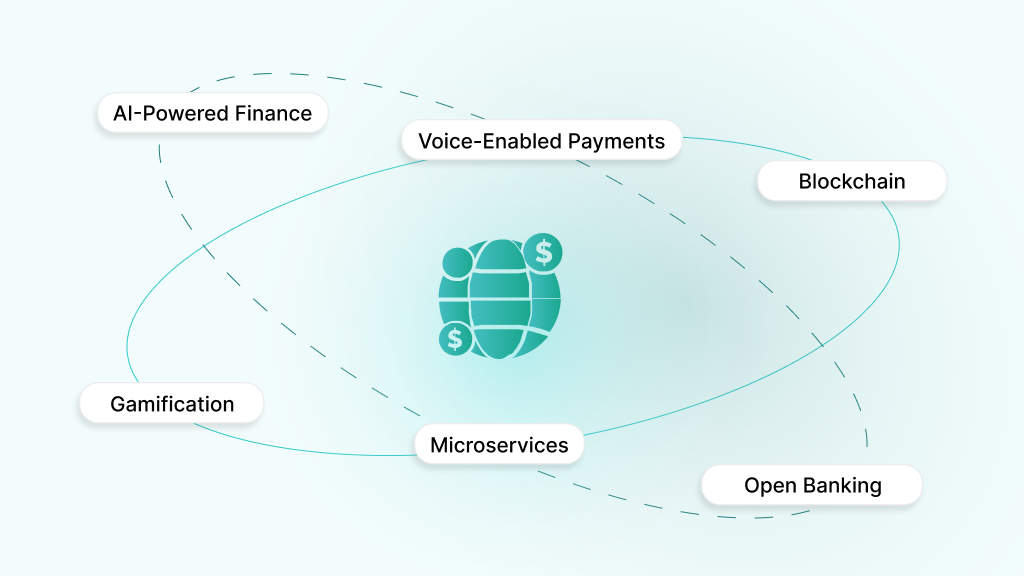

The fintech industry is experiencing several significant trends that will shape opportunities for new startups. Being familiar with these trends enables entrepreneurs to identify where to focus their efforts and position their products effectively for success.

- AI-Powered Finance: AI is now core to credit scoring, fraud detection, investment management, and customer support. Fintechs utilize machine learning to match or surpass traditional banks in terms of precision and speed.

- Voice-Enabled Payments: With smart speakers and voice assistants embedded in phones and cars, users expect to check balances, transfer funds, and make payments hands-free. Fintechs are building secure voice-first experiences.

- Blockchain Beyond Cryptocurrency: Blockchain use cases now include smart contracts that automate agreements, identity verification systems that enhance security, and cross-border settlements that reduce transaction time and costs.

- Gamification for Financial Behavior: Apps utilize challenges, streaks, and rewards to foster budgeting, saving, and credit-building habits, particularly among younger users who value interactivity and instant feedback.

- Microservices Architecture: Most modern fintechs are shifting to modular microservices for speed, scalability, and easier updates. This enables teams to release features more quickly and respond promptly to compliance changes.

- Open Banking and API Integration: As open banking expands in the US, fintechs can securely access financial data from banks to offer personalized insights, credit tools, and automated services, all while complying with regulations and operating at scale.

How to Turn Fintech Ideas into Successful Businesses

A fintech idea is only the starting point. Building a viable product in this space requires a structured approach, regulatory alignment, and a sustained alignment with the product-market fit. Here is how successful companies approach it:

- Define a focused use case: Begin with a specific financial problem faced by an identified user segment. Avoid broad solutions in the early stage; depth in one use case builds retention, clarity, and defensibility.

- Integrate compliance into the product architecture: Financial products must meet strict regulatory standards. Delaying compliance planning increases technical debt. Collaborate with legal and compliance professionals from the outset to ensure the product is audit-ready and compliant with regulatory requirements.

- Prioritize credibility through user experience: Design directly impacts trust. Users must feel confident performing transactions and sharing sensitive data. Intuitive flows, explicit language, and transparent logic are critical, especially in financial applications.

- Build with infrastructure: Partner with banks, payment processors, and Banking-as-a-Service (BaaS) platforms to reduce time-to-market. These integrations allow your team to focus on core differentiation rather than replicating foundational systems.

- Establish financial discipline early: Strong unit economics are essential. Understand acquisition costs, lifetime value, and retention patterns before scaling. Growth without margins is difficult to sustain in regulated industries.

- Validate through direct user interaction: Product direction must be grounded in real behaviors, not assumptions. Invest time in observing workflows, pain points, and decision triggers within your target segment to uncover actionable insights.

Conclusion

The most successful fintech startup ideas solve focused, real-world problems with speed, clarity, and built-in trust. But strong execution calls for regulatory alignment, technical precision, and a product team that understands financial infrastructure.

DEVtrust partners with fintech founders to turn high-potential startup ideas into fully operational platforms. When PayVantage needed to build a lending solution from scratch, we developed their complete digital loan stack, automating onboarding, KYC, repayment, and performance tracking. Today, the platform supports thousands of borrowers and lenders with stability and scale.

If you have finalized your fintech startup idea and want an experienced team that has built and scaled in this space before, book a call with us to discuss your scope and see how we can support your needs.

Top Fintech Startup Ideas to Consider in 2025

Explore top fintech startup ideas for 2025 like Robo-Advisory, P2P Lending Apps, and eWallets. Tap into these market opportunities now!

Contact Us