In 2025, mid-to-large-sized businesses saw a 26% rise in online transactions, with larger enterprises driving 69% of the total payment gateway transaction volume. This highlights how crucial payment gateway integration is to staying competitive.

But for CTOs, founders, and product leaders, the challenge remains: How do you select the right payment gateway, ensure security, and integrate it smoothly into your existing systems without disrupting operations?

If you’re struggling with manual processes, inconsistent user experiences, or slow payment processing, you’re not alone. The right payment gateway integration can improve transaction speed and security, drive customer retention, and enhance overall business efficiency.

This guide will walk you through the step-by-step process of integrating a secure, scalable payment gateway that aligns with your business needs. From setup to post-launch optimization, we’ll cover everything you need for a smooth integration.

Quick Glance

- Streamlined Transactions: Payment gateway integration improves transaction speed and enhances user experience, driving growth and customer retention.

- Enhanced Security: Ensure PCI-DSS compliance, tokenization, and fraud protection to safeguard customer data and reduce risks.

- Choosing the Right Gateway: Select a payment gateway based on fees, global support, and scalability to meet your business needs.

- Custom Integration: Bespoke integrations offer flexibility, seamlessly connecting with your existing CRM and ERP systems.

- Continuous Monitoring: Post-launch optimization and updates ensure your payment system stays secure, efficient, and scalable.

What is a Payment Gateway?

A payment gateway is a digital service used by online businesses to process and authorize payments. It handles transactions through debit or credit cards, digital wallets, and bank transfers.

It acts as the online equivalent of a physical card reader. Payment gateways securely approve or decline transactions on behalf of the business, ensuring smooth, safe exchanges between the customer and the merchant.

Types of Payment Gateways

When integrating a payment gateway into your business, it’s essential to understand the two main types: integrated payment gateways and hosted payment gateways. Both serve the same purpose but operate differently and come with unique advantages.

1. Integrated Payment Gateways

- Direct Payment Processing: These gateways allow customers to pay directly on your website without being redirected to a third-party platform.

- Faster Transactions: Since there’s no redirect, payments are processed quickly, offering a smoother experience.

- API Integration: Integrated gateways use an API to connect directly to your checkout process, making it easier to customize the user experience.

As these gateways handle payments directly on your site, you must ensure reliable security protocols, including encryption and PCI DSS compliance, to protect sensitive information.

2. Hosted Payment Gateways

- External Payment Platform: Hosted gateways redirect customers to a secure third-party platform to complete the payment.

- Simpler Integration: Easy to integrate into your website, as the payment gateway provider handles the hosting and security.

- Slight Delay in Processing: Payments take slightly longer since users are redirected to a different page for payment completion.

- Provider-Managed Security: The provider ensures security and compliance, alleviating the burden of managing payment data on your site.

Each payment gateway type offers distinct advantages. Choose the one that aligns best with your business model, customer experience goals, and security requirements.

So, why does payment gateway integration matter? Let’s take a look at how it impacts your business operations and customer experience.

Why is Payment Gateway Integration Important?

The integration of a payment gateway is essential for modern businesses, as it ensures secure transactions, simplifies operations, and provides valuable insights across all sales channels.

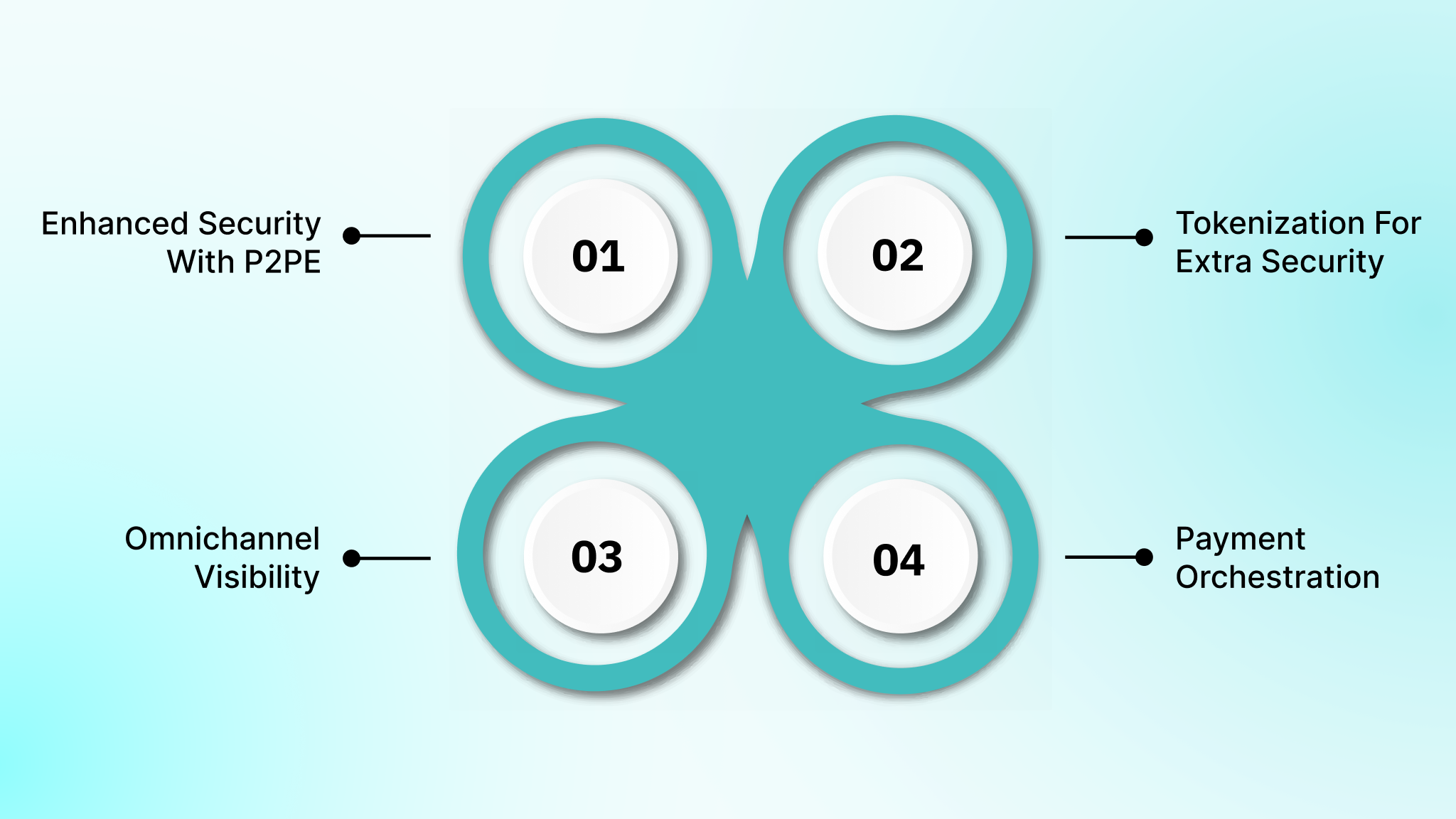

1. Encryption and Scope Control

Payment gateways encrypt customer data during transactions and limit the scope of sensitive information handled by your systems. Using hosted fields, embedded components, or redirect checkouts reduces PCI compliance obligations while maintaining secure, seamless payments.

2. Tokenization for Extra Security

Tokenization replaces sensitive payment data with unique tokens. While the customer’s data is encrypted, businesses can still track transactions, ensuring smooth customer experiences while maintaining security.

3. Omnichannel Visibility

A payment gateway helps businesses unify their sales channels. Whether transactions happen in-store or online, you gain a consolidated view of customer behavior across platforms. This data enables personalized checkouts, tailored discounts, and improved operational efficiency.

4. Payment Orchestration for Streamlined Operations

Integrating a payment gateway sets the stage for payment orchestration: A unified platform that combines multiple payment service providers (PSPs) and methods. This integration simplifies backend processes, enhances payment routing, and provides real-time analytics to improve overall transaction efficiency.

Integrating a payment gateway helps businesses enhance security, simplify operations, and deliver a smooth customer experience, driving long-term growth and efficiency.

Now that you see its importance, let’s break down how payment gateways actually work behind the scenes to process transactions.

How Do Payment Gateways Work?

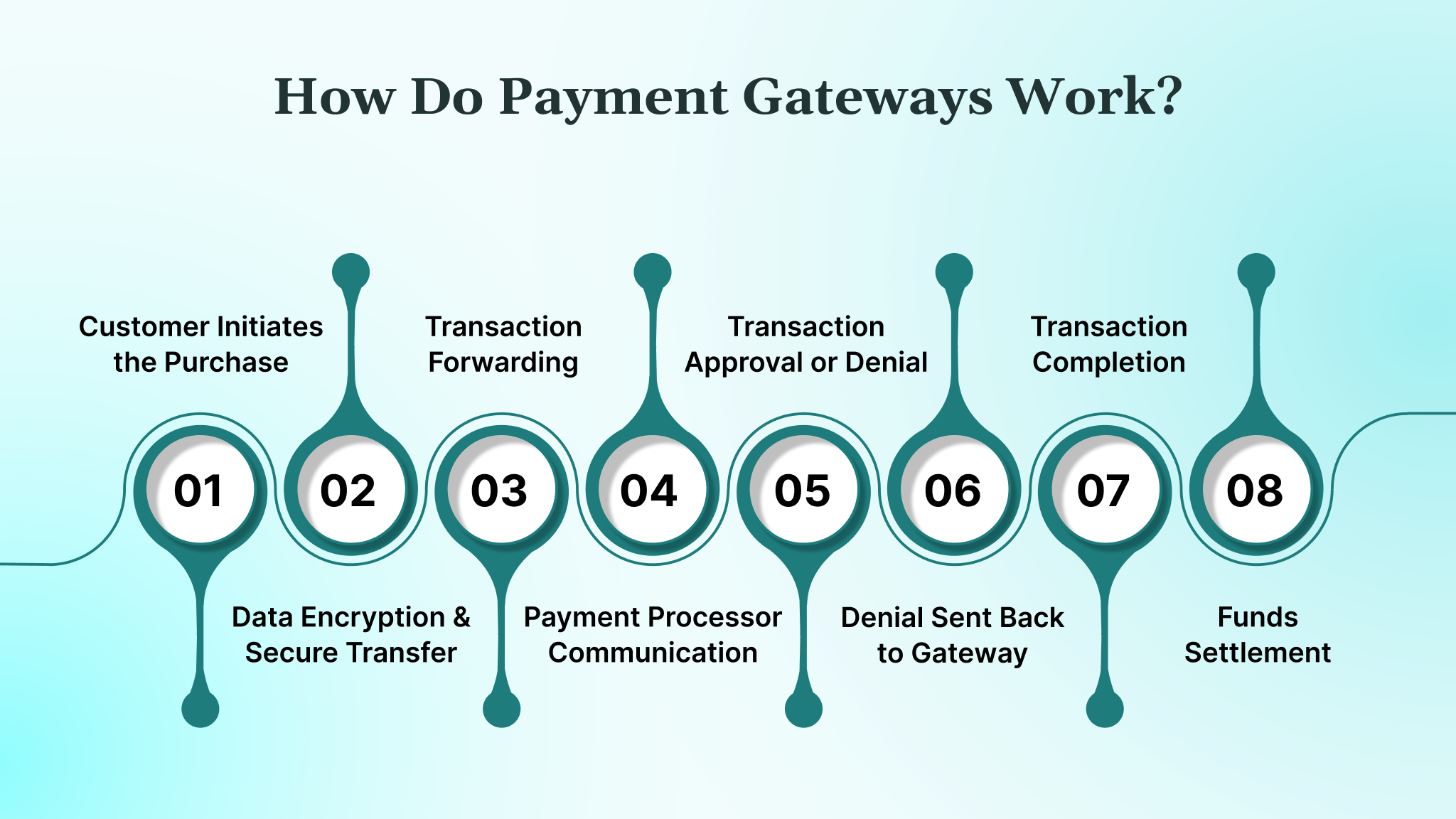

Payment gateways play a crucial role in securely processing online transactions. Here’s a breakdown of how they function:

- Customer Initiates the Purchase: The process begins when a customer selects a product or service and enters payment information, such as credit card or digital wallet details, on your checkout page.

- Data Encryption & Secure Transfer: Once the payment details are entered, the payment gateway encrypts the sensitive data (credit card number, CVV, etc.) and securely transmits it from your website to the payment gateway.

- Transaction Forwarding: The encrypted data is forwarded to the payment processor, which handles the next step in the transaction flow.

- Payment Processor Communication with Card Issuer: The payment processor sends the transaction details to the card-issuing bank or financial institution to verify the transaction and check for available funds.

- Transaction Approval or Denial: The bank evaluates the transaction and approves or denies it based on factors such as available balance and security checks.

- Authentication and Fraud Checks: Before approving the transaction, the gateway or processor performs security checks, such as 3D Secure authentication, fraud detection, and risk assessment, to ensure the payment is legitimate.

- Approval/Denial Sent Back to Gateway: The decision (approved or declined) is communicated back through the payment processor, then to the payment gateway, and finally back to the website.

- Transaction Completion: If the transaction is approved, the purchase is completed, and the customer receives confirmation. If declined, the customer is notified and prompted to try a different payment method.

- Funds Settlement: At the end of the day, the payment gateway sends the approved transaction data to your acquiring bank, which then transfers the funds to your business account. This process can vary based on your agreement with the bank or processor.

Payment gateways act as the secure bridge between your customers and your business, ensuring fast and safe transactions every time a purchase is made.

Also Read: Top Fintech Startup Ideas to Consider in 2025

Next, let’s explore a step-by-step guide to understand how to integrate a payment gateway into your website.

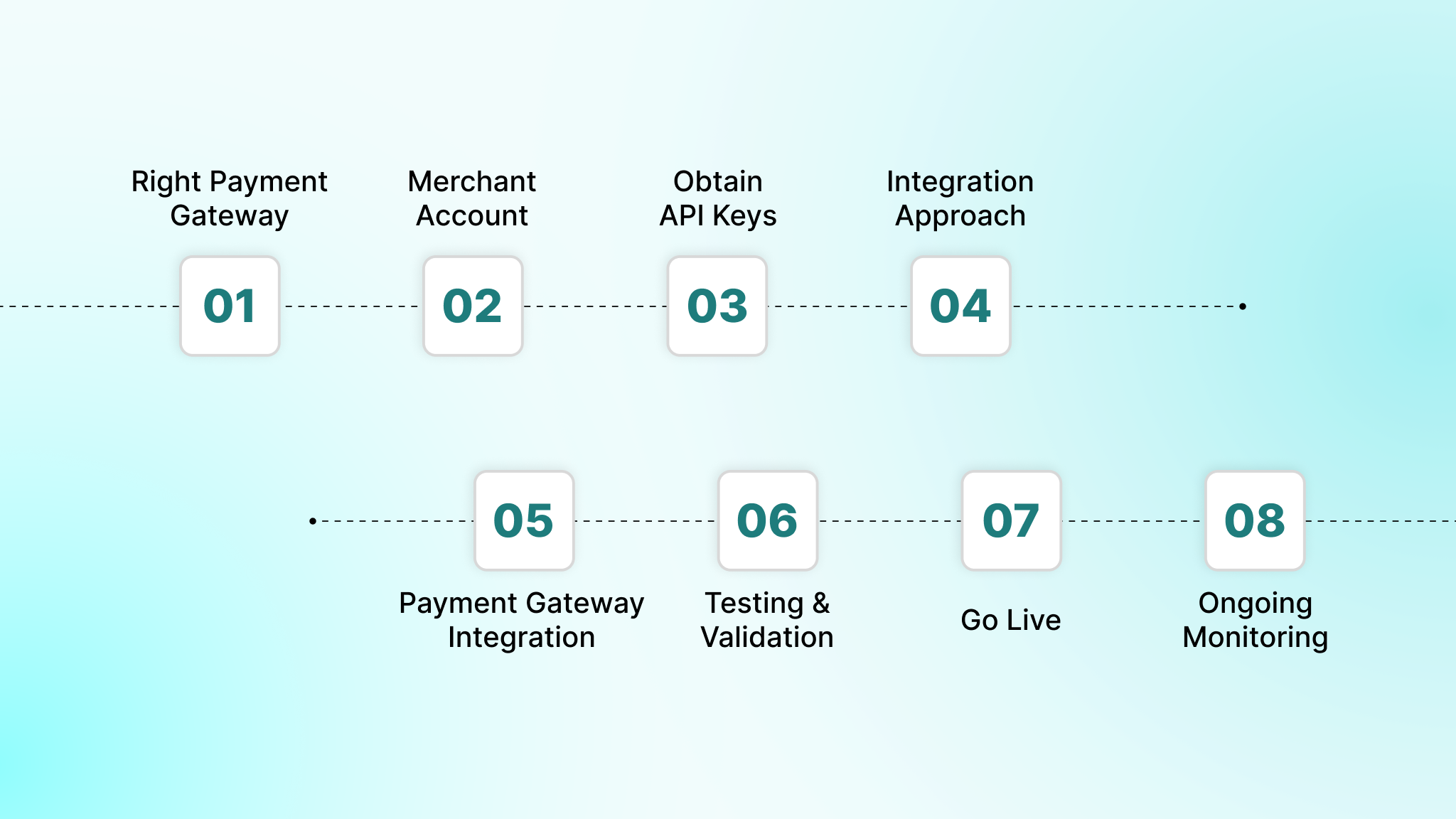

How to Integrate a Payment Gateway into Your Website

Integrating a payment gateway into your website is crucial for securely processing online transactions. Below is a structured step-by-step guide that covers everything you need to know, along with some best practices.

1. Define Requirements and Constraints

Start by defining your business and technical requirements. Identify supported countries, currencies, and payment methods, along with payout timelines. Establish compliance boundaries, including PCI-DSS scope, data retention, and logging requirements, to maintain regulatory standards.

2. Choose an Integration Model

Your integration model impacts both user experience and security obligations. Hosted or redirect checkouts offer fast launches and minimal PCI exposure. Embedded components or hosted fields improve UX while keeping compliance manageable.

3. Set Up Accounts and Environments

Create separate sandbox and production accounts for testing and deployment. Generate distinct API keys per environment and implement strict access control and key rotation policies to protect sensitive credentials.

4. Implement Server-Side Payment Creation

Server-side logic should handle payment session or intent creation. Use idempotency keys to prevent duplicate charges during retries, a pattern supported by most major providers, such as Stripe. This approach keeps sensitive payment logic secure and consistent.

5. Collect Payment Details Safely

Use provider-hosted UI components or SDKs to collect payment details. Avoid sending raw card information through your servers to reduce PCI scope and safeguard sensitive data.

6. Implement Webhooks as the Source of Truth

Webhooks provide authoritative confirmation of payments. Deduplicate events, store event IDs, and build retry-safe handlers. Relying only on front-end success messages can lead to inconsistencies or failed transactions.

7. Build Refunds and Reconciliation Workflows

Automate refund processing and track each transaction’s status. Reconcile settlements and payouts with orders or invoices, and define clear procedures for chargebacks and disputes to ensure accurate financial operations.

8. Test Like Production

Simulate real-world scenarios including successes, failures, retries, partial refunds, and webhook replays. Monitor metrics such as error rates, decline rates, and payout delays to identify and fix issues before customers are affected.

9. Go Live with Guardrails

Roll out gradually using feature flags. Set up alerts for payment failures and webhook delays, and maintain a runbook for incident response to ensure reliable and secure operations from day one.

This step-by-step process ensures your payment gateway is integrated efficiently, securely, and ready to support business growth.

Recommended Read: Top Financial Advisory Apps for Budgeting and Planning 2025

Before you begin the integration process, it’s important to understand the costs involved. Let’s take a look at the potential expenses.

Payment Gateway Integration Costs

When integrating an online payment gateway, understanding the hidden costs and indirect fees is crucial to budget effectively. Here’s a breakdown of the factors influencing your integration costs:

| Cost Factor | Description |

| Setup Charges | Some gateways require a one-time setup fee for access to their services, varying based on reputation and features. |

| Subscription Fees | Many providers charge a monthly or annual subscription fee, either as a flat rate or based on transaction volume. |

| Per-Transaction Fees | Typically, gateways charge a percentage of each transaction, sometimes with an additional fixed fee per transaction. |

| Cross-Border Charges | For international transactions, additional fees apply, especially when currency exchange or cross-border processing is involved. |

| Integration Costs | While some providers offer pre-built plugins, custom integrations for unique setups or platforms come with development expenses. |

| Chargeback Penalties | If transactions lead to chargebacks, gateways may charge penalties to cover admin costs and to maintain quality service standards. |

| Security Expenses | Investments in SSL certificates, fraud prevention tools, and other security measures are necessary to protect payment data, adding to costs. |

| Maintenance and Upgrades | As gateway APIs evolve, ongoing updates and maintenance are required to keep the integration up-to-date and functional. |

| Contract Termination Penalties | If you need to end a contract early, some providers may impose termination fees, making it more expensive to switch gateways. |

| Extra Feature Costs | Advanced features like dedicated support, analytics, or additional fraud protection may incur extra charges, depending on the provider. |

| Compliance Expenditures | Ensuring your integration is PCI DSS-compliant and meets regulatory standards may require additional configurations and fees. |

Carefully considering all these factors helps you avoid surprises and make an informed decision on the most cost-efficient payment gateway for your business needs.

Next, let’s explore how to select the right one that aligns with your business needs.

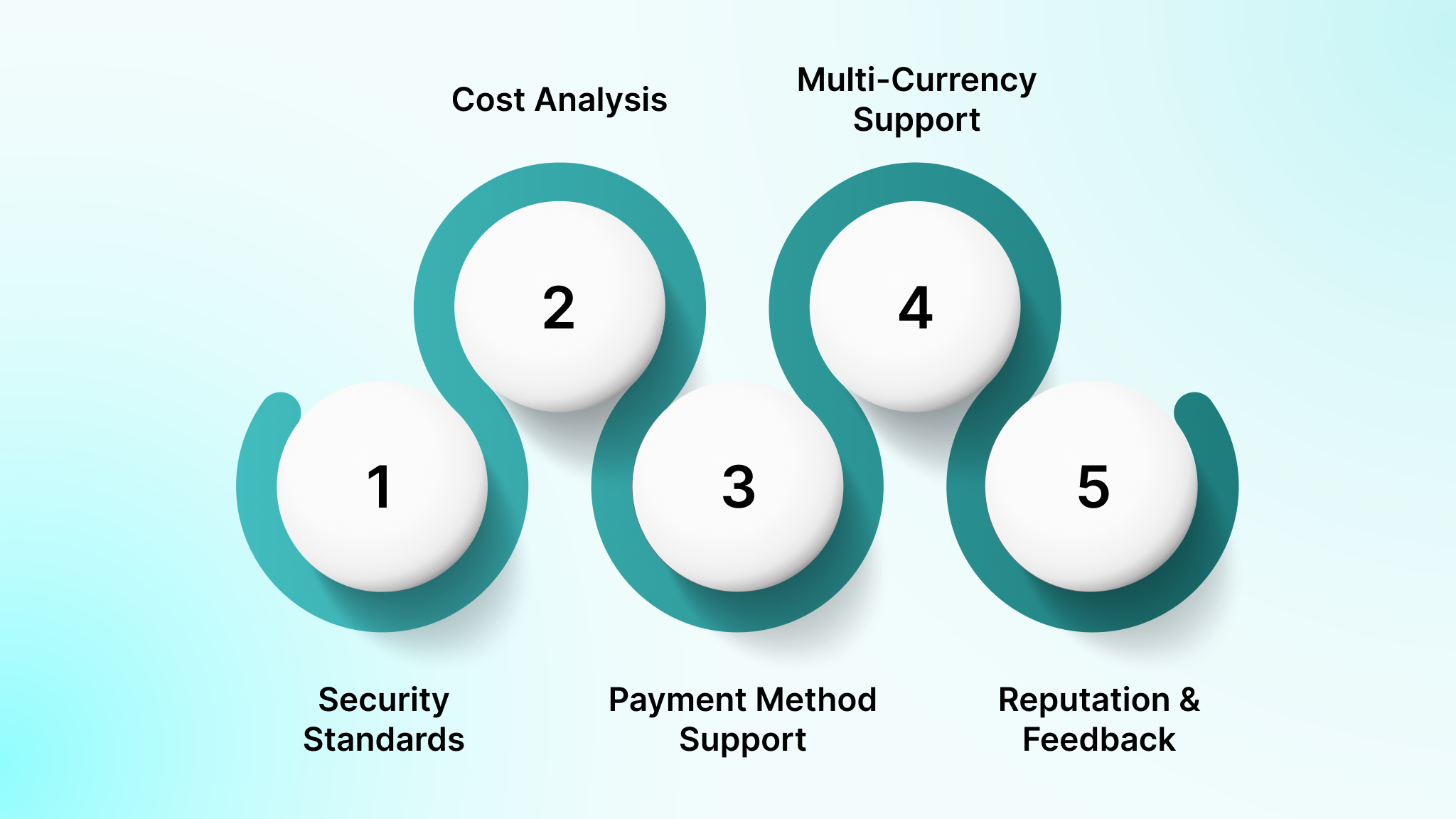

How to Choose the Right Payment Gateway for Your Business

Selecting a payment gateway involves more than just finding a solution that processes payments. To ensure you’re making the right choice, consider these factors that directly impact sales, customer retention, and business trust:

- Security Standards: Ensure the gateway complies with PCI DSS regulations and offers solid fraud protection to safeguard customer data and prevent unauthorized transactions.

- Cost Analysis: Review the gateway’s pricing structure, including transaction fees, monthly charges, setup costs, and any hidden fees that could affect profitability.

- Payment Method Support: Choose a gateway that accepts a wide range of payment methods, from credit cards, debit cards, e-wallets, and mobile wallets, to cater to diverse customer preferences.

- Global & Multi-Currency Support: If you’re targeting international markets, select a gateway that supports currency conversion and localized payment options for global reach.

- Reputation & Feedback: Research customer reviews and testimonials from other businesses to gauge the gateway’s reliability, customer service, and performance in real-world applications.

Evaluating these factors ensures that the payment gateway you choose aligns with your business goals and delivers a smooth, secure experience for your customers.

At DEVtrust, we specialize in building custom solutions that seamlessly integrate payment gateways into your existing systems. Our API integration expertise, cloud architecture capabilities, and focus on security ensure that your payment systems are secure, scalable, and aligned with your business needs.

Ready to integrate a payment gateway that fits your business needs? Let’s discuss in detail how DEVtrust can help make it a smooth and secure process.

Need an Effortless Payment Gateway Integration? Let’s Make It Happen.

At DEVtrust, we know the importance of smooth payment processing for your business. Here’s how we help integrate payment gateways with real business outcomes:

- Bespoke Payment Integrations: We build custom integrations that suit your platform’s unique needs, ensuring your payment systems work smoothly with your existing tools.

- Secure & Scalable Solutions: Our integrations ensure secure transactions and can scale with your business, handling everything from small to high-volume payments.

- Real-Time Data Sync: We ensure real-time payment updates across your systems, making it easier to track transactions and improve operational accuracy.

- Compliance-Ready Systems: We build with PCI DSS compliance and other security standards to ensure your data is handled safely and securely.

- Ongoing Support & Updates: After integration, we provide ongoing maintenance to ensure your payment systems stay efficient and up-to-date.

Let’s build a payment gateway integration that meets your immediate needs and scales with your business as it grows, ensuring smooth transactions and enhanced efficiency every step of the way.

Conclusion

Integrating a payment gateway is about processing transactions while creating a secure and efficient experience for your business and your customers. The right integration can simplify operations, enhance customer satisfaction, and drive growth.

But with so many options available, choosing and implementing the right solution can be challenging.

Whether you’re looking to simplify your payment processes, integrate with your existing systems, or scale your operations, a well-executed payment gateway integration can set your business up for long-term success.

DEVtrust designs and builds secure, customized payment gateway integrations that reduce PCI scope, handle webhook-driven payment states correctly, and support refunds, reconciliation, and observability from day one. We work with platforms like Stripe, PayPal, Plaid, and TransUnion, and integrate supporting systems such as fraud detection, bank verification, and risk scoring when your payment flow requires it.

Contact us today to start the conversation.