In 2025, mobile banking apps are at the heart of the fintech revolution, transforming how customers manage finances with secure, on-the-go access. Over 2.1 billion people globally used mobile banking services in 2024, a number expected to grow significantly.

Leading fintech players are innovating rapidly, integrating AI, biometrics, and personalized financial tools into sleek digital platforms. If your organization aims to stay relevant in this new era, developing a next-gen mobile banking app is the way forward. This guide provides a detailed roadmap for developing a mobile banking app, covering essential features, security practices, technology stacks, development steps, and emerging trends for 2025.

You will learn how to create a secure, user-friendly app that enhances customer engagement and streamlines financial operations. Let’s start by understanding what a mobile banking app entails.

Key Takeaways

- Mobile banking app development is essential in 2025: With over 2.1 billion users globally and growing demand for 24/7 access to financial services, custom mobile banking apps help organizations meet customer expectations, enhance engagement, and gain a competitive edge in the fintech space.

- A successful app requires both essential and advanced features: Core functionalities like biometric authentication, fund transfers, and card management ensure usability, while advanced tools like AI budgeting, chatbot banking, and investment services boost retention and user satisfaction.

- The right technology stack ensures performance, security, and scalability: Flutter or React Native enables cross-platform development, while Node.js or Django powers backend systems. Integrating biometric APIs, end-to-end encryption, and cloud hosting (AWS, Azure) ensures a secure and responsive user experience.

- A structured development process ensures efficiency and compliance: From discovery and design to backend development, testing, and maintenance, each step should focus on secure integrations, intuitive UX, and adherence to KYC, AML, and data protection regulations.

- Security and legal compliance are non-negotiable: Mobile banking apps must comply with GDPR, PCI-DSS, and regional regulations. Implement OWASP guidelines, AI-powered fraud detection, multi-factor authentication, and encrypted data storage to build user trust and ensure regulatory approval.

What Is a Mobile Banking App?

A mobile banking app is a software platform that allows users to perform financial tasks, such as checking balances, transferring funds, and paying bills, via smartphones or tablets. It integrates with banking systems to provide secure, real-time access to accounts and services.

Types include retail banking apps for individual users, neo-banking apps for digital-first platforms like Chime, corporate banking apps for businesses, and investment platforms for trading stocks or mutual funds. Key functionalities include account management, transaction processing, bill payments, and customer support, all designed to offer convenience and efficiency for users.

Understanding the scope of mobile banking apps leads us to explore why building one in 2025 is a strategic move.

Why Build a Mobile Banking App in 2025?

In 2025, customers expect seamless, 24/7 access to financial services, driving demand for robust mobile banking apps. Developing a custom app offers significant advantages for a big organization or a fintech startup.

- Meeting Customer Expectations: Users demand instant access to banking services, with 78% preferring mobile apps for daily transactions (Statista, 2024). A custom app delivers tailored, user-friendly experiences.

- Competitive Advantage: Stand out from competitors by offering unique features like AI budgeting or voice banking, attracting tech-savvy customers, and retaining existing ones.

- Enhanced Customer Engagement: Personalized notifications and in-app support foster stronger connections, increasing user retention by up to 25% compared to traditional banking methods.

- Operational Efficiency Through Automation: Automate tasks like bill payments and transfers, reducing manual workloads and operational costs for your organization.

- Scalability for Future Needs: Build a flexible platform that integrates with emerging technologies like blockchain or AI, ensuring your app evolves with industry trends.

Build a Secure, Scalable Banking App with DEVtrust

Need a partner who understands fintech compliance, user-centric design, and real-time banking infrastructure? DEVtrust’s team builds custom mobile banking solutions that meet today’s demands and tomorrow’s challenges. Contact us today to get started.

With these benefits in mind, let’s examine the core features your mobile banking app should include.

Core Features of a Mobile Banking App

A successful mobile banking app requires a robust set of features to meet user needs and ensure operational efficiency. You must balance essential functionalities with advanced tools to create a competitive, user-friendly platform in 2025.

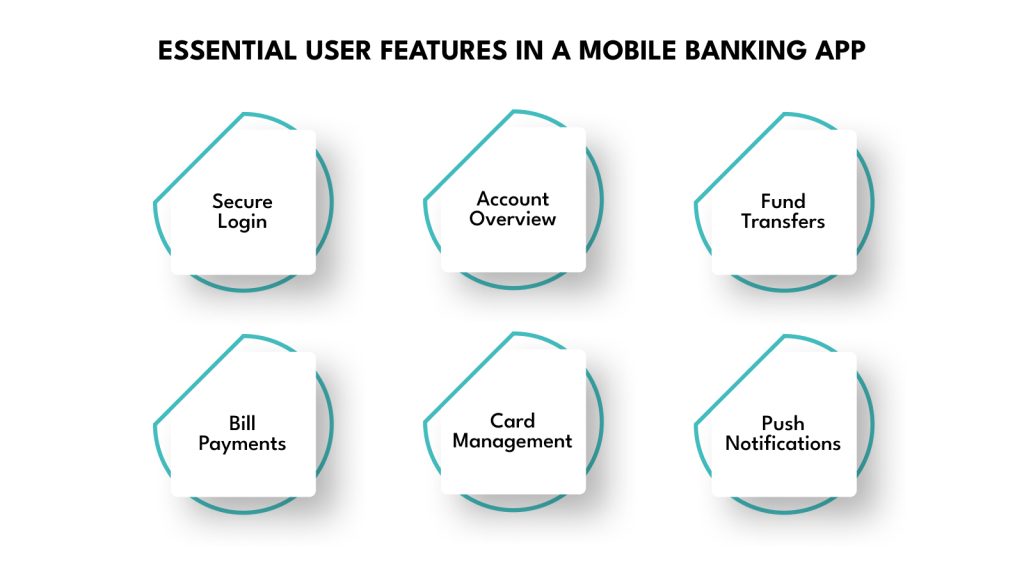

Essential User Features

These foundational features ensure users can manage their finances seamlessly and securely.

- User Registration & Biometric Authentication: Enable secure sign-up with email, phone, or social logins, and use Face ID or fingerprint for quick, safe access.

- Balance Check & Transaction History: Display real-time account balances and detailed transaction logs for user transparency.

- Fund Transfers (IMPS, NEFT, RTGS, P2P): Support instant and scheduled transfers within and across banks, including peer-to-peer payments.

- Bill Payments & Recharge: Allow users to pay utility bills, credit cards, or mobile recharges directly in the app.

- Card Management (Block/Unblock, Limits): Let users control card settings, such as blocking lost cards or setting spending limits.

- Push Notifications and Alerts: Send real-time updates for transactions, low balances, or security alerts to keep users informed.

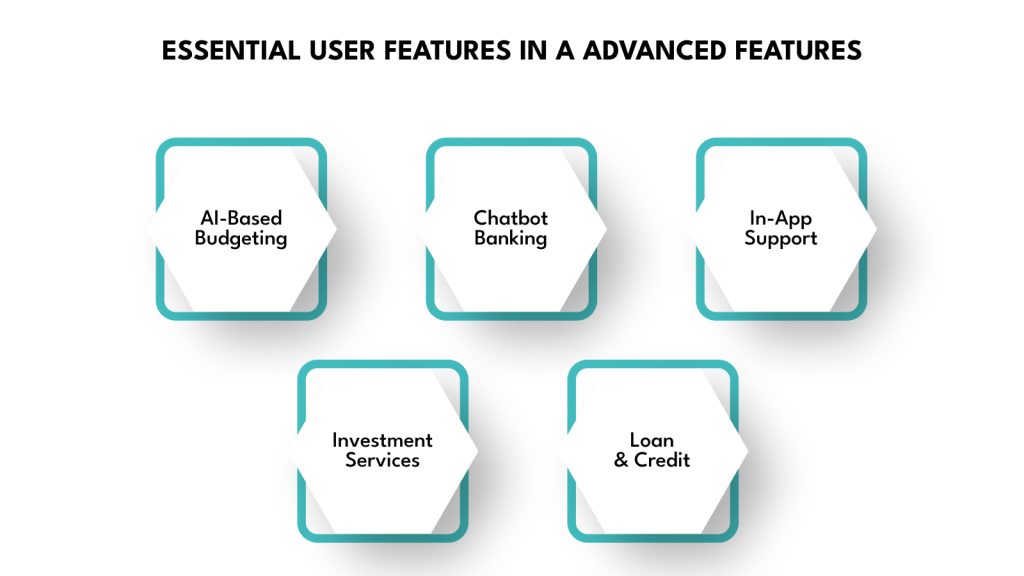

Advanced Features

Incorporate these features to enhance user engagement and align with 2025’s fintech trends.

- AI-Based Budgeting and Spending Insights: Analyze user spending patterns to offer personalized budgeting tips and savings goals.

- Voice and Chatbot Banking: Enable voice commands or chatbot assistance for tasks like checking balances or scheduling payments.

- In-App Customer Support: Provide live chat or ticketing systems for quick issue resolution, improving user satisfaction.

- Investment Services (Mutual Funds, Stocks): Offer tools for buying, tracking, and managing investments within the app.

- Loan Application and Credit Score Tracking: Streamline loan applications and provide real-time credit score updates for financial planning.

With your app’s features defined, let’s explore the technology stack needed for development.

Technology Stack for Mobile Banking Apps

Choosing the right technology stack ensures your mobile banking app is secure, scalable, and user-friendly. You need tools that support real-time transactions, robust security, and seamless integrations to meet 2025’s fintech demands.

Frontend Technologies

- Flutter, React Native: Build cross-platform apps for iOS and Android with a single codebase, reducing development time and costs.

- Swift (iOS), Kotlin (Android): Use native languages for high-performance apps with platform-specific features, ideal for enterprise solutions.

Backend Technologies

- Node.js: Offers fast, scalable server-side logic for real-time transaction processing and notifications.

- Java Spring Boot: Provides robust, enterprise-grade frameworks for secure, high-volume banking systems.

- Python (Django): Ensures rapid development with built-in security features for complex backend logic.

Database and Cloud

- PostgreSQL: Manages structured data like user accounts and transactions, ensuring reliability.

- MongoDB: Handles unstructured data like user preferences or logs, offering flexibility.

- AWS, Azure, Google Cloud Platform: Provide secure, scalable hosting with compliance for financial data.

Security Integrations

- Biometric API (Face ID, Fingerprint): Enable secure, user-friendly authentication methods.

- SSL/TLS Encryption, Tokenization: Protect data in transit and at rest, securing transactions.

- Multi-Factor Authentication (MFA): Require multiple verification steps to prevent unauthorized access.

- PCI-DSS and GDPR Compliance: Ensure adherence to payment and data privacy standards through certified integrations.

With your technology stack selected, let’s outline the step-by-step process for developing your mobile banking app.

Step-by-Step Mobile Banking App Development Process

Building a mobile banking app requires a structured approach to ensure security, functionality, and user satisfaction. Each step, from planning to maintenance, is critical to delivering a reliable solution in 2025.

Step 1: Discovery and Planning

Conduct market research to analyze competitors like Revolut or N26, identifying gaps in features or user experience. Define core functionalities, such as fund transfers and bill payments, and compliance requirements like KYC and GDPR. Create a project roadmap with budget estimates ($50,000-$250,000) and timelines, aligning stakeholders on goals and scope.

Step 2: UI/UX Design

Develop wireframes using tools like Figma to map user journeys for account management or payments. Design simple, accessible interfaces with high-contrast visuals and large fonts for inclusivity. Prioritize secure interactions, like biometric login prompts, and test designs with users to ensure trust and usability.

Step 3: Backend and Frontend Development

Build secure APIs to connect with banking systems and payment gateways like Stripe. Implement backend logic with Node.js or Django for transaction processing and frontend interfaces with Flutter for responsive mobile apps. Integrate real-time data sync and notification services for seamless user experiences.

Step 4: Testing and Compliance Checks

Conduct unit testing for features like transfers, integration testing for APIs, and usability testing for user flows. Perform load testing to handle peak transaction volumes and security audits for PCI-DSS and GDPR compliance. Ensure KYC and AML requirements are met through automated verification processes.

Step 5: Deployment and Maintenance

Launch your app on the App Store and Google Play, ensuring compatibility with iOS and Android. Set up monitoring tools like Firebase Crashlytics to track performance and crashes. Schedule continuous security patches and feature upgrades to maintain compliance and user satisfaction.

With the development process outlined, let’s address the critical security considerations for your banking app.

Security Considerations in Banking App Development

Security is paramount in mobile banking apps to protect user data and transactions. You must implement robust measures to ensure trust and compliance in 2025’s fintech landscape.

- End-to-End Encryption for Transactions: Use TLS 1.3 to secure data transfers, ensuring no interception during payments or account access.

- Secure Coding Practices (OWASP Guidelines): Follow OWASP’s top 10 security principles to prevent vulnerabilities like SQL injection or cross-site scripting.

- Real-Time Fraud Detection Systems: Implement AI-driven monitoring to flag suspicious activities, such as unusual transaction patterns, instantly.

- Session Timeout and Transaction Monitoring: Automatically log out inactive users and track transactions for anomalies to enhance security.

- Data Storage and Encryption Best Practices: Use AES-256 encryption for stored data and anonymize sensitive information to comply with privacy laws.

With security measures in place, let’s explore the regulatory and legal considerations for your app.

Regulatory Compliance and Legal Considerations

Compliance with regional and global regulations is essential to operate a mobile banking app legally and maintain user trust. You must navigate a complex landscape to ensure adherence.

- Regional Banking Regulations: Comply with RBI (India), FDIC (U.S.), or FCA (UK) guidelines, which govern financial transactions, licensing, and consumer protections.

- Know Your Customer (KYC): Implement automated ID verification to confirm user identities, preventing fraud and meeting anti-money laundering (AML) requirements.

- Anti-Money Laundering (AML): Use transaction monitoring and reporting to detect and prevent illegal financial activities, as mandated by regulators.

- Data Privacy Laws (GDPR, CCPA): Ensure user consent, data minimization, and right-to-erasure options to comply with GDPR (EU) and CCPA (California).

- Audit Logs and Compliance Reporting: Maintain detailed logs of user activities and transactions for regulatory audits, ensuring transparency and accountability.

With compliance addressed, let’s examine the estimated costs of developing your mobile banking app.

Cost of Mobile Banking App Development

Understanding the costs of mobile banking app development helps you budget effectively. Costs vary based on features, security requirements, and team expertise in 2025.

- MVP Development Cost: $50,000-$80,000 for core features like balance checks and transfers, suitable for startups or small banks.

- Full-Feature Enterprise App: $100,000-$250,000 for advanced features like AI budgeting and investment services, ideal for large institutions.

- Cost Drivers: Feature complexity, security integrations (e.g., MFA), compliance audits, and developer rates ($50-$150/hour by region).

- Ongoing Costs: Maintenance, security patches, and server hosting cost 15-20% of initial development annually.

With costs clarified, let’s explore common challenges in mobile banking app development.

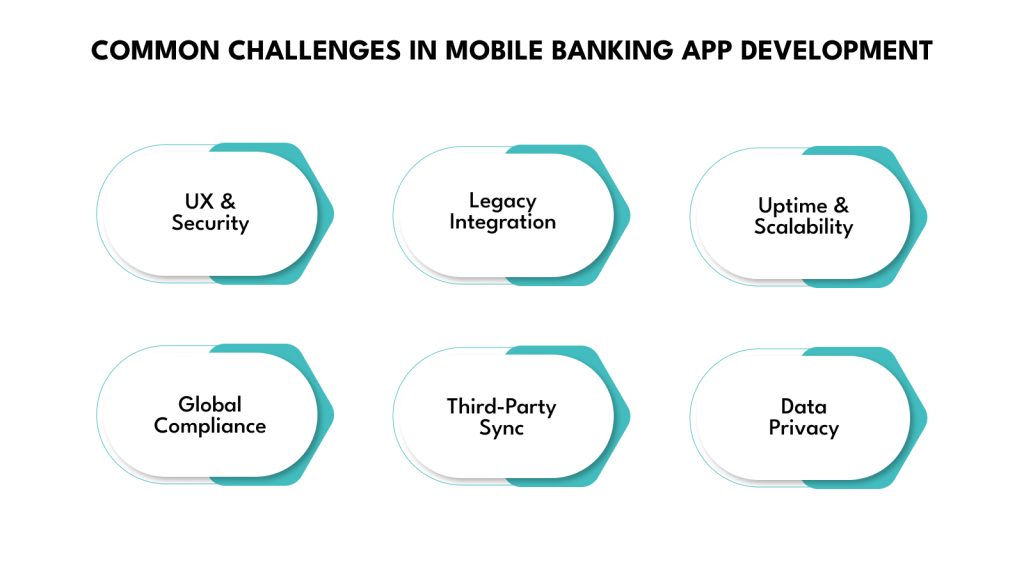

Common Challenges in Mobile Banking App Development

Developing a mobile banking app involves navigating technical and regulatory hurdles. Addressing these challenges ensures a robust, user-friendly solution.

- Balancing User Experience with Robust Security: Users expect intuitive interfaces, but stringent security requirements like multi-factor authentication (MFA) can complicate navigation. Simplify login flows with biometric options like Face ID while maintaining encryption and MFA to protect data, and test with users to ensure usability doesn’t compromise safety.

- Integrating with Legacy Banking Systems: Many banks rely on outdated core banking systems, making integration complex and prone to data mismatches. Use middleware solutions like MuleSoft to bridge legacy systems with modern APIs, and map data structures early to minimize compatibility issues during development.

- Maintaining High Uptime and Scalability: High transaction volumes, especially during peak times like tax season, demand 99.9% uptime. Leverage cloud platforms like AWS or Azure with load balancers to scale dynamically, and conduct stress tests to ensure your app handles thousands of concurrent users without crashing.

- Handling Cross-Border Regulatory Compliance: Operating in multiple regions requires compliance with diverse regulations like RBI (India), FDIC (U.S.), or GDPR (EU). Consult legal experts to implement region-specific KYC and AML processes, and design flexible systems to adapt to varying compliance requirements without extensive rework.

- Ensuring Seamless Third-Party Integrations: Connecting with payment gateways like Stripe or external services like credit scoring tools can lead to API errors or delays. Test integrations thoroughly using tools like Postman, and maintain fallback mechanisms to ensure functionality if third-party services experience outages.

- Managing User Data Privacy Concerns: Users are increasingly wary of data breaches, especially with sensitive financial information. Implement privacy-by-design principles, such as data anonymization and minimal collection, and communicate transparent privacy policies to build trust and comply with GDPR or CCPA.

With these challenges addressed, you are better equipped to create a mobile banking app that balances functionality, security, and user satisfaction.

Conclusion

The future of finance is mobile, intelligent, and secure. From personalized budgeting tools to seamless fund transfers, customers expect a banking experience that is fast, intuitive, and available around the clock. The organizations that rise to meet this moment will set the pace for years to come. DEVtrust specializes in creating custom mobile banking apps that enhance user engagement and streamline financial operations.

Our expertise in technologies such as Flutter, Node.js, and AWS enables us to deliver secure, scalable solutions tailored to your specific needs. Our team integrates advanced features like AI-driven budgeting and voice banking, ensuring compliance with GDPR, PCI-DSS, and KYC standards.

Partner with DEVtrust to transform your financial services with an efficient banking app. Contact our experts today to discuss your project, and we will build a solution that drives customer satisfaction, ensures regulatory compliance, and positions your organization for success in 2025’s fintech scene.

Comprehensive Mobile Banking App Development Guide

Embark on mobile banking application development. Focus on target audience, define features, ensure compliance, pick tech stack, and secure data. Start building now!

Contact Us